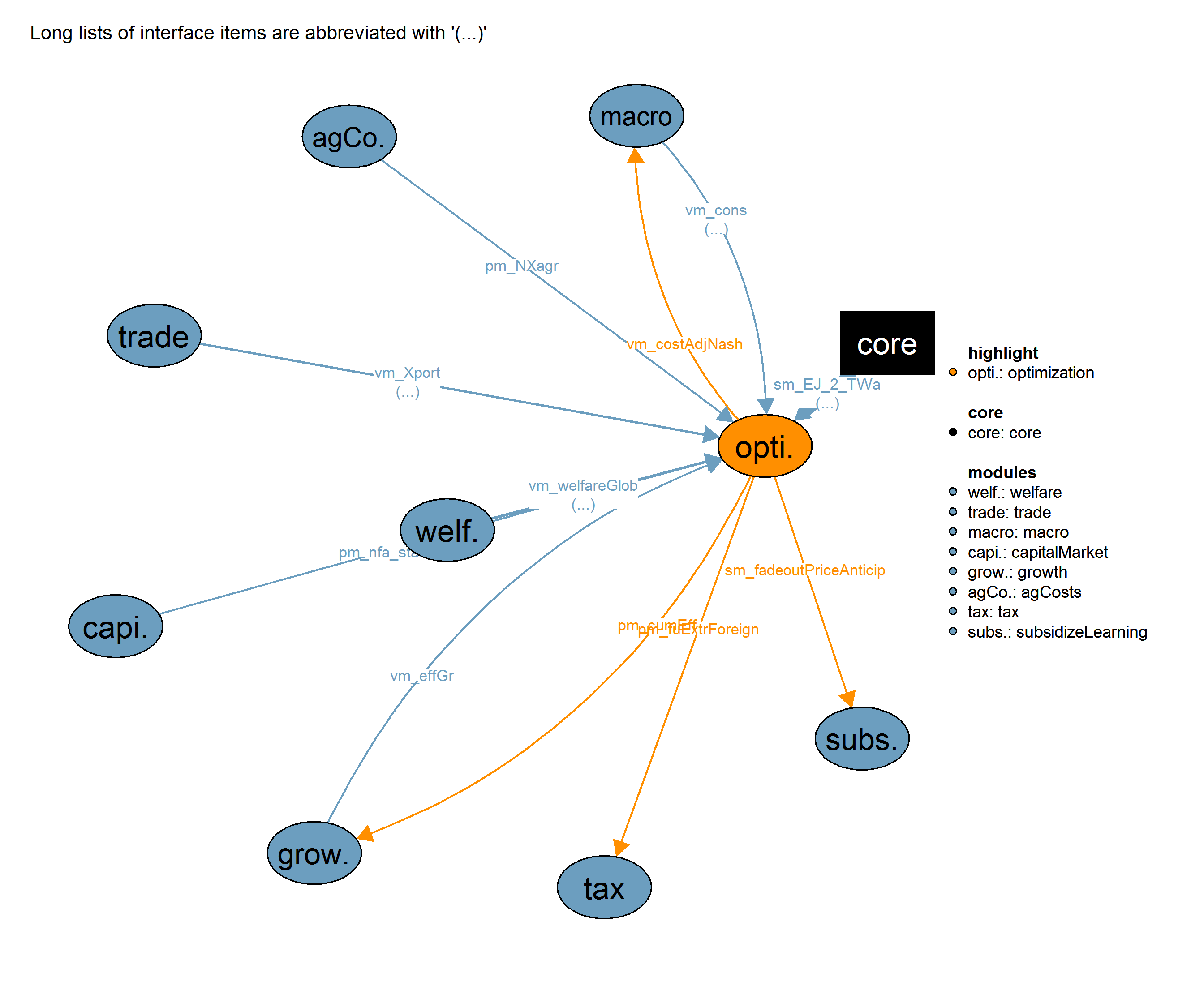

Optimization (80_optimization)

Description

The optimization module gives the opportunity to choose different solution algorithms.

Interfaces

Input

| Description | Unit | A | B | C | |

|---|---|---|---|---|---|

| cm_emiscen | policy scenario choice | x | x | ||

| cm_iteration_max | number of Negishi iterations (up to 49) | x | |||

| cm_nash_autoconverge | choice of nash convergence mode | x | |||

| cm_startyear | first optimized modelling time step | \(year\) | x | x | x |

| pm_budgetCO2eq (all_regi) |

budget for regional energy-emissions in period 1 | x | |||

| pm_capCum0 (tall, all_regi, all_te) |

vm_capCum from last iteration | x | |||

| pm_capCumForeign (ttot, all_regi, all_te) |

parameter for learning externality (cumulated capacity of other regions except regi) | x | x | x | |

| pm_cesdata (tall, all_regi, all_in, cesParameter) |

parameters of the CES function | x | |||

| pm_co2eq0 (tall, all_regi) |

vm_co2eq from last iteration | x | |||

| pm_co2eqForeign (tall, all_regi) |

emissions, which are part of the climate policy, of other regions (nash relevant) | x | x | x | |

| pm_emicapglob (tall) |

global emission cap | x | x | ||

| pm_emissions0 (tall, all_regi, all_enty) |

Emissions in last iteration | x | |||

| pm_emissionsForeign (tall, all_regi, all_enty) |

total emissions of other regions (nash relevant) | x | x | x | |

| pm_nfa_start (all_regi) |

initial net foreign asset | x | |||

| pm_NXagr (tall, all_regi) |

Net agricultural exports | x | x | ||

| pm_pop (tall, all_regi) |

population data | \(bn people\) | x | x | |

| pm_prtp (all_regi) |

Pure rate of time preference | x | |||

| pm_pvp (ttot, all_enty) |

Price on commodity markets | x | x | x | |

| pm_pvpRegi (ttot, all_regi, all_enty) |

prices of traded commodities - regional. only used for permit trade | x | |||

| pm_shPerm (tall, all_regi) |

emission permit shares | x | x | ||

| pm_SolNonInfes (all_regi) |

model status from last iteration. 1 means status 2 or 7, 0 for all other status codes | x | x | x | |

| pm_taxCO2eq (ttot, all_regi) |

CO2 tax path in T$/GtC = $/kgC. To get $/tCO2, multiply with 272 | \(T\$/GtC\) | x | ||

| pm_ts (tall) |

(t_n+1 - t_n-1)/2 for a timestep t_n | x | x | x | |

| pm_ttot_val (ttot) |

value of ttot set element | x | |||

| pm_w (all_regi) |

Negishi weights | x | x | x | |

| pm_welf (tall) |

Weight parameter in the welfare function to avoid jumps with cm_less_TS | x | |||

| pm_Xport0 (tall, all_regi, all_enty) |

Reference level value of export. | x | x | ||

| qm_budget (ttot, all_regi) |

Budget balance | x | x | ||

| qm_co2eqCum (all_regi) |

cumulate regional emissions over time | x | |||

| sm_budgetCO2eqGlob | budget for global energy-emissions in period 1 | x | |||

| sm_EJ_2_TWa | multiplicative factor to convert from EJ to TWa | x | |||

| sm_endBudgetCO2eq | end time step of emission budget period 1 | x | |||

| sm_eps | small number: 1e-9 | x | |||

| sm_tmp | temporary scalar that can be used locally | x | |||

| vm_co2eq (ttot, all_regi) |

total emissions measured in co2 equivalents ATTENTION: content depends on multigasscen. | \(GtCeq\) | x | ||

| vm_cons (ttot, all_regi) |

Consumption | x | x | x | |

| vm_dummyBudget (ttot, all_regi) |

auxiliary variable that helps to meet permit allocation equation in nash case | x | |||

| vm_effGr (ttot, all_regi, all_in) |

growth of factor efficiency | x | |||

| vm_emiAll (ttot, all_regi, all_enty) |

total regional emissions. | \(GtC, Mt CH4, Mt N\) | x | ||

| vm_emiTe (ttot, all_regi, all_enty) |

total energy-related emissions of each region. | \(GtC, Mt CH4, Mt N\) | x | ||

| vm_fuExtr (ttot, all_regi, all_enty, rlf) |

fuel use | \(TWa\) | x | x | |

| vm_Mport (tall, all_regi, all_enty) |

Import of traded commodity. | x | x | x | |

| vm_perm (ttot, all_regi) |

emission allowances | x | |||

| vm_prodPe (ttot, all_regi, all_enty) |

pe production. | \(TWa, Uranium: Mt Ur\) | x | x | |

| vm_taxrev (ttot, all_regi) |

difference between tax volume in current and previous iteration | x | x | x | |

| vm_welfareGlob | Global welfare | x | x | x | |

| vm_Xport (tall, all_regi, all_enty) |

Export of traded commodity. | x | x | x |

Output

| Description | Unit | |

|---|---|---|

| pm_cumEff (tall, all_regi, all_in) |

parameter for spillover externality (aggregated productivity level) | |

| pm_fuExtrForeign (ttot, all_regi, all_enty, rlf) |

foreign fuel extraction | |

| sm_fadeoutPriceAnticip | Helper parameter, describes fadeout of price anticipation during iterations | |

| vm_costAdjNash (ttot, all_regi) |

Adjustment costs for deviation from the trade structure of the last iteration. |

Realizations

(A) nash

Unlike in Negishi-mode, each region forms its own optimization problem in Nash mode. Regions trade on goods and resource markets, but market-clearing conditions are not part of the optimization itself. Instead, the Nash-algorithm iteratively computes solutions for all regions including their trade patterns, and adjusts prices such that the surplus on global markets vanishes. Initial values for trade patterns, prices etc. are taken from the gdx (input.gdx).

Potential benefits of a Nash-solution are a massive reduction in run-time (convergence within a few hours), and more flexibility in treating inter-regional externalities. Learning-by-doing technologies (learnte) are included by default and cause an inter-regional spill-over. This causes a welfare difference between the solution in Nash- and Negishi-mode. In Nash-mode, a subsidy on the investment cost of learning technologies can be used to internalize this spill-over externality. This subsidy is implemented in the module 22_subsidizeLearning.

Without internalizing the learning-by-doing spill-over due to the global learning curve, Nash and Negishi solution differ. This is the case in the default setting of the corresponding module: cfg\(gms\)subsidizeLearning <- “off” In Nash-mode, the subsidy internalizing this externality can be calculated. When activated by cfg\(gms\)subsidizeLearning <- “globallyOptimal” the Nash solution should be equivalent to the Negishi solution.

For Nash solution: intertemporal trade balance must be zero (couple in agricultural trade costs: pvp deflator * net export)

\[\begin{multline*} 0 = pm\_nfa\_start(regi) \cdot pm\_pvp("2005","good") + SUM\left(ttot\$\left(ttot.val ge 2005\right), pm\_ts(ttot) \cdot \left( SUM\left(trade, \left(vm\_Xport(ttot,regi,trade) - vm\_Mport(ttot,regi,trade)\right) \cdot pm\_pvp(ttot,trade) \cdot \left( 1 + sm\_fadeoutPriceAnticip \cdot p80\_etaXp(trade) \cdot \frac{ \left( \left(pm\_Xport0(ttot,regi,trade) - p80\_Mport0(ttot,regi,trade)\right) - \left(vm\_Xport(ttot,regi,trade) - vm\_Mport(ttot,regi,trade)\right) - p80\_taxrev0(ttot,regi)\$\left(ttot.val gt 2005\right)\$sameas(trade,"good") + vm\_taxrev(ttot,regi)\$\left(ttot.val gt 2005\right)\$sameas(trade,"good") \right) }{ \left(p80\_normalize0(ttot,regi,trade) + sm\_eps\right) }\right) \right) + pm\_pvp(ttot,"good") \cdot pm\_NXagr(ttot,regi) \right) \right) \end{multline*}\]

quadratic adjustment costs, penalizing deviations from the trade pattern of the last iteration.

\[\begin{multline*} vm\_costAdjNash(ttot,regi) = \sum_{trade}\left( pm\_pvp(ttot,trade) \cdot p80\_etaAdj(trade) \cdot \left( \left(pm\_Xport0(ttot,regi,trade) - p80\_Mport0(ttot,regi,trade)\right) - \left(vm\_Xport(ttot,regi,trade) - vm\_Mport(ttot,regi,trade)\right) \right) \cdot \frac{ \left( \left(pm\_Xport0(ttot,regi,trade) - p80\_Mport0(ttot,regi,trade)\right) - \left(vm\_Xport(ttot,regi,trade) - vm\_Mport(ttot,regi,trade)\right) \right) }{ \left(p80\_normalize0(ttot,regi,trade) + sm\_eps\right) }\right) \end{multline*}\]

link between permit budget and emission budget

\[\begin{multline*} \sum_{ttot\$\left(ttot.val lt sm\_endBudgetCO2eq and ttot.val ge cm\_startyear\right)}\left( pm\_ts(ttot) \cdot vm\_perm(ttot,regi)\right) + \sum_{ttot\$\left(ttot.val eq sm\_endBudgetCO2eq\right)}\left(\frac{pm\_ts(ttot)}{2 } \cdot vm\_perm(ttot,regi)\right) \leq pm\_budgetCO2eq(regi) - \sum_{ttot \$\left(\left(ttot.val ge 2005\right) and \left(ttot.val lt cm\_startyear\right)\right)}\left( pm\_ts(ttot) \cdot vm\_co2eq(ttot,regi)\right) \end{multline*}\]

Limitations There are no known limitations.

(B) negishi

In Negishi mode, all regions forms a big optimization problem, as opposed to separate optimizations in Nash mode. Regions trade on goods and resource markets, and market-clearing conditions are also part of the optimization. The Negishi algorithm iteratively computes solutions for the whole globe including regional trade patterns, and adjusts the so-called Negishi weights until a Pareto optimal solution is found. Negishi weights are the coefficients of regional utilities in their sum that forms the utility function of REMIND and are computed via an intertemporal trade balance.

Initial values for the Negishi weights are taken from the gdx (input.gdx).

\[\begin{multline*} SUM\left(regi, vm\_Xport(t,regi,trade) - vm\_Mport(t,regi,trade)\right) = 0 \end{multline*}\]

\[\begin{multline*} 1 \geq 1 \end{multline*}\]

Limitations This realization is computationally very expensive. Unless a very specific problem has to be solved, using the Nash realization will deliver the same result in a fraction of the time.

(C) testOneRegi

This is a reduced model version, only containing one region. It is equivalent to the Nash realization with just one region. Prices of resources and goods are exogenously fixed to the values taken from the gdx.

Run time is some minutes.

for Nash solution: intertemporal trade balance must be zero

\[\begin{multline*} 0 = SUM\left(ttot\$\left(ttot.val ge 2005\right), pm\_ts(ttot) \cdot SUM\left(trade, \left(vm\_Xport(ttot,regi,trade)-vm\_Mport(ttot,regi,trade)\right) \cdot pm\_pvp(ttot,trade) \cdot \left( 1 + p80\_etaXp(trade) \cdot \frac{ \left( \left(pm\_Xport0(ttot,regi,trade) - p80\_Mport0(ttot,regi,trade)\right) - \left(vm\_Xport(ttot,regi,trade) - vm\_Mport(ttot,regi,trade)\right) \right) }{ \left(p80\_normalize0(ttot,regi,trade) + 1E-6\right) }\right) \right) \right) \end{multline*}\]

\[\begin{multline*} vm\_costAdjNash(ttot,regi) = 0 \end{multline*}\]

Limitations This realization is only useful for testing purposes or for regions with no influence on the global prices of traded goods.

Definitions

Objects

| Description | Unit | A | B | C | |

|---|---|---|---|---|---|

| p80_alpha_nw (tall, all_regi) |

diagnostic parameter for new negishi routine | x | |||

| p80_count | count regions with feasible solution | x | |||

| p80_curracc (ttot, all_regi) |

current account | x | x | ||

| p80_currentaccount_bau (tall, all_regi) |

baseline current account path | x | |||

| p80_defic (iteration, all_regi) |

intertemporal trade balance deficit | x | |||

| p80_defic_sum (iteration) |

Surplus in monetary terms over all times on all commodity markets combined [trillion US$2005] (NOTE: to compare this number with the Negishi defic_sum, divide by around 100) | x | x | ||

| p80_defic_sum_rel (iteration) |

Surplus monetary value over all times on all commodity markets combined, normalized to consumption | \(\%\) | x | ||

| p80_defic_sumLast | the sum of intertemporal deficits, only for the last iteration (needed for output analysis script) | x | |||

| p80_defic_trade (all_enty) |

Surplus in monetary terms over all times on commodity markets | \(trillion US\$2005\) | x | ||

| p80_eoDeltaEmibudget | total change in permit budget | x | |||

| p80_eoEmibudget1RegItr (all_regi, iteration) |

corrected regional permit budgets | x | |||

| p80_eoEmibudgetDiffAbs (iteration) |

convergence indicator | x | |||

| p80_eoEmiMarg (all_regi) |

weighted marginal utility of emissions | x | |||

| p80_eoMargAverage | global average of marginals from nash budget equation | x | |||

| p80_eoMargDiff (all_regi) |

scaled deviation of regional marginals from global average | x | |||

| p80_eoMargDiffItr (all_regi, iteration) |

scaled deviation of regional marginals from global average | x | |||

| p80_eoMargEmiCum (all_regi) |

marginal of cumulative emissions | x | |||

| p80_eoMargPermBudg (all_regi) |

marginal of permit budget restriction | x | |||

| p80_eoWeights (all_regi) |

welfare weights | x | |||

| p80_eoWeights_fix (all_regi) |

hard coded fallback nash weights | x | |||

| p80_etaAdj (all_enty) |

Adjustment costs for changes of trade pattern between iterations | x | |||

| p80_etaLT (all_enty) |

long term price ajustment elasticity | x | |||

| p80_etaLT_correct (all_enty, iteration) |

long term price correction factor in percent | x | |||

| p80_etaST (all_enty) |

short term price ajustment elasticity | x | |||

| p80_etaST_correct (tall, all_enty, iteration) |

short term price correction factor in percent | x | |||

| p80_etaXp (all_enty) |

Parameter governing price anticipation on commodity markets | x | x | ||

| p80_handle (all_regi) |

parallel mode handle parameter | x | |||

| p80_messageFailedMarket (tall, all_enty) |

nash display helper | x | |||

| p80_messageShow (convMessage80) |

nash display helper | x | |||

| p80_Mport0 (tall, all_regi, all_enty) |

Imports in last iteration | x | x | ||

| p80_nfa (tall, all_regi) |

net foreign assets | x | |||

| p80_normalize0 (ttot, all_regi, all_enty) |

Normalization parameter for market volume | x | x | ||

| p80_normalizeLT (all_enty) |

Aggregated intertemporal market volume | x | |||

| p80_nw (iteration, all_regi) |

negishi weights | x | |||

| p80_pvp_itr (ttot, all_enty, iteration) |

Price on commodity markets per iteration | x | |||

| p80_pvpFallback (ttot, all_enty) |

Helper parameter. Price path from input/prices_NASH.inc. Only used if reading prices from gdx fails. | x | x | ||

| p80_repy (all_regi, solveinfo80) |

summary report from solver | x | |||

| p80_repy_iteration (all_regi, solveinfo80, iteration) |

summary report from solver in iteration | x | |||

| p80_repyLastOptim (all_regi, solveinfo80) |

p80_repy from last iteration | x | |||

| p80_SolNonOpt (all_regi) |

solve status | x | |||

| p80_surplus (tall, all_enty, iteration) |

Surplus on commodity market | x | |||

| p80_surplusMax (all_enty, iteration, tall) |

Diagnostics for Nash: Worst residual market surplus until given year, absolute value. | \(Units: TWa, trillion Dollar, GtC\) | x | ||

| p80_surplusMax2100 (all_enty) |

Worst residual market surplus until 2100, absolute value. | \(Units: TWa, trillion Dollar, GtC\) | x | ||

| p80_surplusMaxRel (all_enty, iteration, tall) |

Diagnostics for Nash: Worst residual market surplus until given year, in per cent. | x | |||

| p80_surplusMaxTolerance (all_enty) |

maximum tolerable residual value of absolute market surplus in 2100. | x | |||

| p80_t_interpolate (tall, tall) |

weights to interpolate from t_input_gdx to t | x | |||

| p80_taxrev_agg (tall, iteration) |

vm_taxrev globally from last iteration | x | |||

| p80_taxrev0 (tall, all_regi) |

vm_taxrev from last iteration | x | x | ||

| p80_trade (ttot, all_regi, all_enty) |

trade surplusses | x | |||

| p80_tradeVolume (tall, all_regi, all_enty) |

Trade volume | x | |||

| p80_tradeVolumeAll (tall, all_regi) |

Trade volume of all traded goods | x | |||

| q80_balTrade (ttot, all_enty) |

trade balance equation | x | |||

| q80_budg_intertemp (all_regi) |

interemporal trade balance (Nash mode only) | x | x | ||

| q80_budget_helper (ttot, all_regi) |

Helper declaration for import from gdx | x | |||

| q80_budgetPermRestr (all_regi) |

constraints regional permit budget to given regional emission budget | x | |||

| q80_costAdjNash (ttot, all_regi) |

calculate Nash adjustment costs (of anticipation of the difference in trade pattern, compared to the last iteration), combined for all markets | x | x | ||

| s80_after | value of time step after current interpolation time step | x | |||

| s80_alpha_avg | average of p80_alpha_nw | x | |||

| s80_before | value of time step befor current interpolation time step | x | |||

| s80_bool | helper | x | |||

| s80_cnptfile | parameter that indicates which optimality tolerance will be used | x | x | x | |

| s80_converged | if nash converged, this is 1 | x | |||

| s80_dummy | dummy scalar | x | |||

| s80_fadeoutPriceAnticipStartingPeriod | Helper parameter, denotes iteration in which price anticipation fadeout starts | x | |||

| s80_numberIterations | display helper | x |

Sets

| description | |

|---|---|

| all_enty | all types of quantities |

| all_in | all inputs and outputs of the CES function |

| all_regi | all regions |

| all_te | all energy technologies, including from modules |

| c_expname | c_expname as set for use in GDX |

| cesParameter | parameters of the CES functions and for calibration |

| convMessage80 | contains possible reasons for failed convergence |

| enty(all_enty) | all types of quantities |

| in(all_in) | All inputs and outputs of the CES function |

| iteration | iterator for main (Negishi/Nash) iterations |

| learnte_dyn80(all_te) | learnte for nash |

| modules | all the available modules |

| nash_sol_itr80 | nash iterations |

| regi(all_regi) | all regions used in the solution process |

| regi_dyn80(all_regi) | region for testOneRegi |

| rlf | cost levels of fossil fuels |

| run | iterator for performance test iterations |

| set | regi_nucscen(all_regi) regions which nucscen applies to |

| solveinfo80 | Nash solution stats |

| t(ttot) | modeling time, usually starting in 2005, but later for fixed delay runs |

| t_input_gdx(ttot) | t loaded from input.gdx, used for t interpolation |

| t_interpolate(ttot) | periods that need interpolation |

| tall | time index |

| te(all_te) | energy technologies |

| teLearn(all_te) | Learning technologies (investment costs can be reduced) |

| trade(all_enty) | All traded commodities |

| tradePe(all_enty) | Traded primary energy commodities |

| ttot(tall) | time index with spin up |

Authors

Anastasis Giannousakis, Marian Leimbach, Lavinia Baumstark, Gunnar Luderer, Anselm Schultes

See Also

01_macro, 02_welfare, 20_growth, 21_tax, 22_subsidizeLearning, 23_capitalMarket, 24_trade, 26_agCosts, core