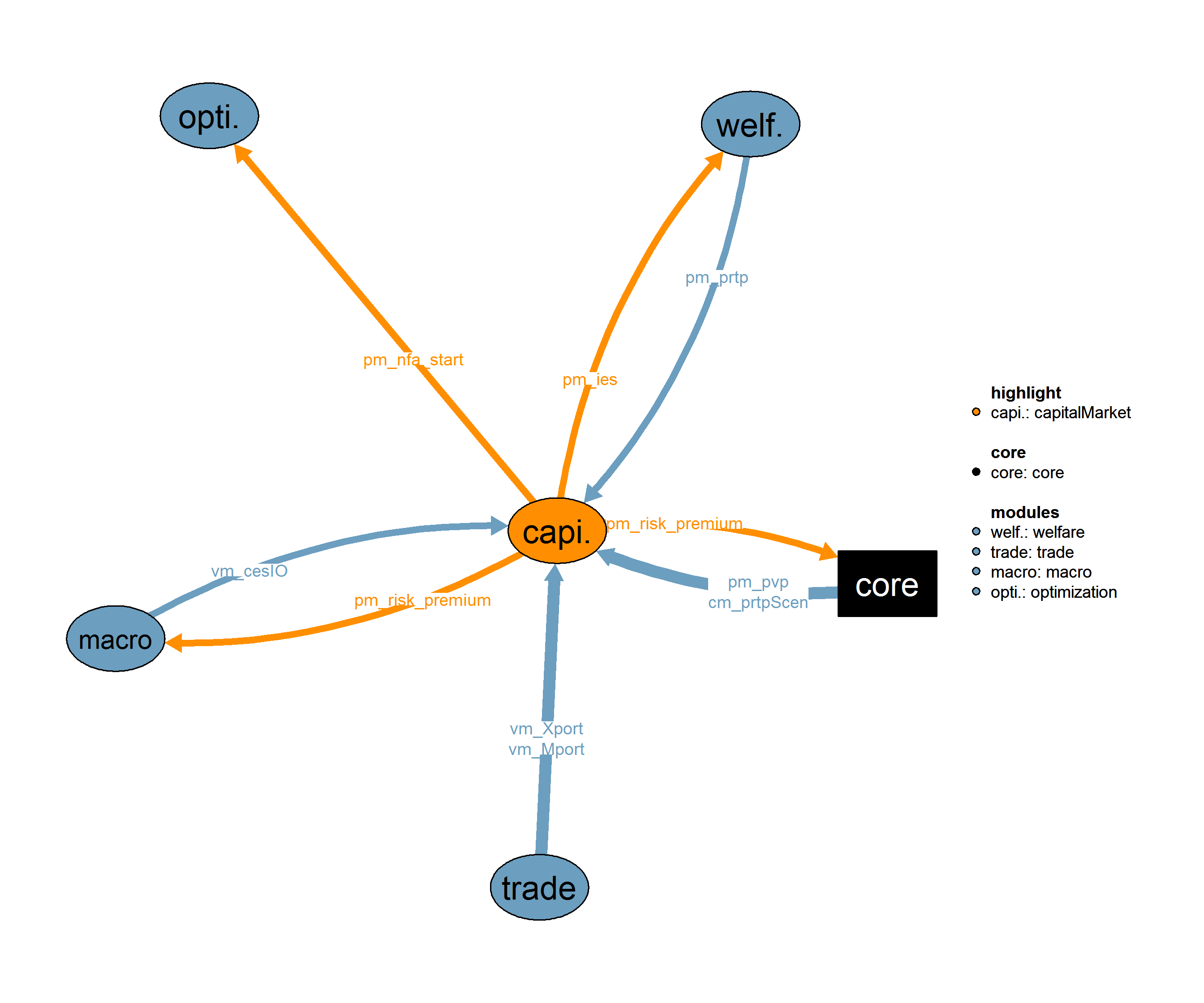

Capital Market (23_capitalMarket)

Description

The capital market module determines direction and volume of capital flows (which are linked to the export and import of goods and energy, and which is accounted for in the intertemporal trade balance). By directing the goods trade, the capital market implementation affects the consumption path.

Interfaces

Input

| Description | Unit | A | B | C | |

|---|---|---|---|---|---|

| cm_prtpScen | pure rate of time preference standard values | x | |||

| pm_prtp (all_regi) |

Pure rate of time preference | x | |||

| pm_pvp (ttot, all_enty) |

Price on commodity markets | x | x | ||

| vm_cesIO (tall, all_regi, all_in) |

Production factor | x | x | ||

| vm_Mport (tall, all_regi, all_enty) |

Import of traded commodity. | x | x | ||

| vm_Xport (tall, all_regi, all_enty) |

Export of traded commodity. | x | x |

Output

| Description | Unit | |

|---|---|---|

| pm_ies (all_regi) |

intertemporal elasticity of substitution | |

| pm_nfa_start (all_regi) |

initial net foreign asset | |

| pm_risk_premium (all_regi) |

risk premium that lowers the use of capital imports |

Realizations

(A) debt_limit

The debt_limit realization assumes restricted capital mobility represented by a debt constraints.

\[\begin{multline*} vm\_cesIO(t,regi,"inco") \cdot p23\_debt\_growthCoeff(regi) \geq vm\_Mport(t,regi,"good") - vm\_Xport(t,regi,"good") + SUM\left(tradePe, \left(\frac{pm\_pvp(t,tradePe)}{\left(pm\_pvp(t,"good")+0.000000001\right)}\right) \cdot \left(vm\_Mport(t,regi,tradePe)- vm\_Xport(t,regi,tradePe)\right)\right) + \left(\frac{pm\_pvp(t,"perm")}{\left(pm\_pvp(t,"good")+0.000000001\right)}\right) \cdot \left(vm\_Mport(t,regi,"perm") - vm\_Xport(t,regi,"perm")\right) \end{multline*}\]

\[\begin{multline*} -1.0 \cdot vm\_cesIO(t,regi,"inco") \cdot p23\_debt\_growthCoeff(regi) \leq vm\_Mport(t,regi,"good") - vm\_Xport(t,regi,"good") + SUM\left(tradePe, \left(\frac{pm\_pvp(t,tradePe)}{\left(pm\_pvp(t,"good")+0.000000001\right)}\right) \cdot \left(vm\_Mport(t,regi,tradePe)- vm\_Xport(t,regi,tradePe)\right)\right) + \left(\frac{pm\_pvp(t,"perm")}{\left(pm\_pvp(t,"good")+0.000000001\right)}\right) \cdot \left(vm\_Mport(t,regi,"perm") - vm\_Xport(t,regi,"perm")\right) \end{multline*}\]

Limitations The resulting consumption paths and current accounts in initial periods fit roughly to empirical data, but not as well as with imperfect market realization.

(B) imperfect

This realization considers imperfections on capital markets represented by constraints (e.g. limits on debt accumulation) and risk mark-ups on capital flows. Moreover, regionally differentiated preference paramters (so-called savings wedges) cover institutional imperfections. Compared to the perfect capital market realization, this realization substantially improves the fit of simulation results (initial consumption paths and current accounts) with the data.

\[\begin{multline*} vm\_cesIO(t,regi,"inco") \cdot p23\_debtCoeff \geq \sum_{ttot\$\left(ttot.val le t.val\right)}\left( SUM\left(trade, \left(\frac{pm\_pvp(ttot,trade)}{\left(pm\_pvp("2005","good") + 0.0000000001\right)}\right) \cdot \left(vm\_Mport(ttot,regi,trade)- vm\_Xport(ttot,regi,trade)\right)\right) \right) \end{multline*}\]

\[\begin{multline*} vm\_cesIO(t,regi,"inco") \cdot p23\_debt\_growthCoeff(regi) \geq vm\_Mport(t,regi,"good") - vm\_Xport(t,regi,"good") + SUM\left(tradePe, \left(\frac{pm\_pvp(t,tradePe)}{\left(pm\_pvp(t,"good")+0.000000001\right)}\right) \cdot \left(vm\_Mport(t,regi,tradePe)- vm\_Xport(t,regi,tradePe)\right)\right) + \left(\frac{pm\_pvp(t,"perm")}{\left(pm\_pvp(t,"good")+0.000000001\right)}\right) \cdot \left(vm\_Mport(t,regi,"perm") - vm\_Xport(t,regi,"perm")\right) \end{multline*}\]

Limitations This implementation ist still under construction.

(C) perfect

The perfect capital market realization assumes unrestricted capital mobility and investments decisions that are based on uniform savings behavior (equal time preferences and intertemporal elasticities of substitution) across regions.

Limitations The resulting consumption paths and current accounta in initial periods do not fit to empirical data. Energy system dynamics and mitigation costs are hardly affected.

Definitions

Objects

| Description | Unit | A | B | C | |

|---|---|---|---|---|---|

| p23_debt_growthCoeff (all_regi) |

maximum indebtness growth as share of GDP | x | x | ||

| p23_debtCoeff | maximum indebtness as share of GDP | x | |||

| p23_prtp (all_regi) |

regionally differentiated pure rate of time preference | x | |||

| q23_limit_debt (ttot, all_regi) |

debt constraint | x | |||

| q23_limit_debt_growth (ttot, all_regi) |

debt growth constraint | x | x | ||

| q23_limit_surplus_growth (ttot, all_regi) |

surplus growth constraint | x |

Sets

| description | |

|---|---|

| all_enty | all types of quantities |

| all_in | all inputs and outputs of the CES function |

| all_regi | all regions |

| modules | all the available modules |

| regi(all_regi) | all regions used in the solution process |

| t(ttot) | modeling time, usually starting in 2005, but later for fixed delay runs |

| tall | time index |

| trade(all_enty) | All traded commodities |

| tradePe(all_enty) | Traded primary energy commodities |

| ttot(tall) | time index with spin up |

Authors

Marian Leimbach

See Also

01_macro, 02_welfare, 24_trade, 80_optimization, core