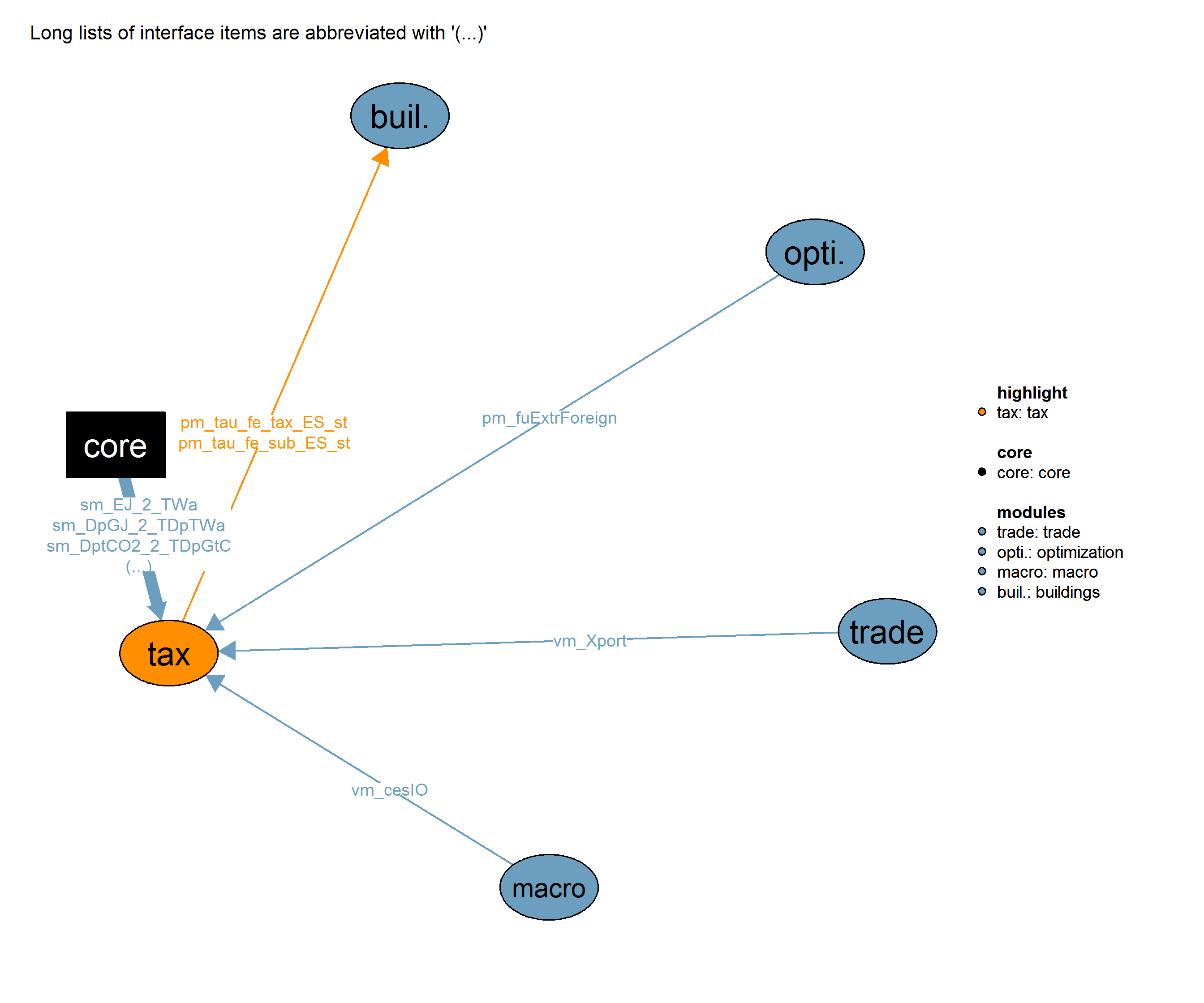

(21_tax)

Description

Interfaces

Input

| Description | Unit | A | B | |

|---|---|---|---|---|

| cm_bioenergy_tax | level of bioenergy tax in fraction of bioenergy price | x | ||

| cm_cprice_red_factor | reduction factor for price on co2luc when calculating the revenues. Replicates the reduction applied in MAgPIE | x | ||

| cm_DiscRateScen | Scenario for the implicit discount rate applied to the energy efficiency capital | x | ||

| cm_emiscen | policy scenario choice | x | ||

| cm_fetaxscen | choice of final energy tax path, subsidy path and inconvenience cost path, values other than 0 make setting module 21_tax on | x | ||

| cm_frac_CCS | tax on CCS to reflect risk of leakage, formulated as fraction of ccs O&M costs | x | ||

| cm_frac_NetNegEmi | tax on CDR to reflect risk of overshooting, formulated as fraction of carbon price | x | ||

| cm_gdximport_target | whether or not the starting value for iteratively adjusted budgets, tax scenarios, or forcing targets (emiscen 5,6,8,9) should be read in from the input.gdx | x | ||

| cm_multigasscen | scenario on GHG portfolio to be included in permit trading scheme | x | ||

| cm_so2tax_scen | level of SO2 tax | x | ||

| cm_startyear | first optimized modelling time step | \(year\) | x | |

| pm_data (all_regi, char, all_te) |

Large array for most technical parameters of technologies; more detail on the individual technical parameters can be found in the declaration of the set ‘char’ | x | ||

| pm_dataccs (all_regi, char, rlf) |

maximum CO2 storage capacity using CCS technology. | \(GtC\) | x | |

| pm_fuExtrForeign (ttot, all_regi, all_enty, rlf) |

foreign fuel extraction | x | ||

| pm_gdp_gdx (tall, all_regi) |

GDP path from gdx, updated iteratively. | x | ||

| pm_inco0_t (ttot, all_regi, all_te) |

New inco0 that is time-dependent for some technologies. | \(T\$/TW\) | x | |

| pm_pop (tall, all_regi) |

population data | \(bn people\) | x | |

| pm_taxCO2eq (ttot, all_regi) |

CO2 tax path in T$/GtC = $/kgC. To get $/tCO2, multiply with 272 | \(T\$/GtC\) | x | |

| pm_taxCO2eqHist (ttot, all_regi) |

Historic CO2 tax path in 2010 and 2015 (also in BAU!) in T$/GtC = $/kgC. To get $/tCO2, multiply with 272 | \(T\$/GtC\) | x | |

| pm_taxCO2eqSCC (ttot, all_regi) |

carbon tax component due to damages (social cost of carbon) | x | ||

| pm_ts (tall) |

(t_n+1 - t_n-1)/2 for a timestep t_n | x | ||

| pm_ttot_val (ttot) |

value of ttot set element | x | ||

| sm_ccsinjecrate | CCS injection rate factor. Unit: 1/a | x | ||

| sm_DpGJ_2_TDpTWa | multipl. factor to convert (Dollar per GJoule) to (TerraDollar per TWyear) | x | ||

| sm_DptCO2_2_TDpGtC | Conversion multiplier to go from \(/tCO2 to T\)/GtC: 44/12/1000 | x | ||

| sm_EJ_2_TWa | multiplicative factor to convert from EJ to TWa | x | ||

| vm_cesIO (tall, all_regi, all_in) |

Production factor | x | ||

| vm_co2CCS (ttot, all_regi, all_enty, all_enty, all_te, rlf) |

all differenct ccs. | \(GtC/a\) | x | |

| vm_co2eq (ttot, all_regi) |

total emissions measured in co2 equivalents ATTENTION: content depends on multigasscen. | \(GtCeq\) | x | |

| vm_costSubsidizeLearning (ttot, all_regi) |

regional cost of subsidy for learning technologies | x | ||

| vm_demFeForEs (ttot, all_regi, all_enty, all_esty, all_teEs) |

Final energy which will be used in the ES layer. | x | ||

| vm_emiAll (ttot, all_regi, all_enty) |

total regional emissions. | \(GtC, Mt CH4, Mt N\) | x | |

| vm_emiMac (ttot, all_regi, all_enty) |

total non-energy-related emission of each region. | \(GtC, Mt CH4, Mt N\) | x | |

| vm_emiMacSector (ttot, all_regi, all_enty) |

total non-energy-related emission of each region. | \(GtC, Mt CH4, Mt N\) | x | |

| vm_emiTe (ttot, all_regi, all_enty) |

total energy-related emissions of each region. | \(GtC, Mt CH4, Mt N\) | x | |

| vm_fuExtr (ttot, all_regi, all_enty, rlf) |

fuel use | \(TWa\) | x | |

| vm_pebiolc_price (ttot, all_regi) |

Bioenergy price according to MAgPIE supply curves | \(T\$US/TWa\) | x | |

| vm_prodFe (ttot, all_regi, all_enty, all_enty, all_te) |

fe production. | \(TWa\) | x | |

| vm_prodSe (tall, all_regi, all_enty, all_enty, all_te) |

se production. | \(TWa\) | x | |

| vm_taxrev (ttot, all_regi) |

difference between tax volume in current and previous iteration | x | x | |

| vm_Xport (tall, all_regi, all_enty) |

Export of traded commodity. | x |

Output

| Description | Unit | |

|---|---|---|

| pm_tau_fe_sub_ES_st (tall, all_regi, all_esty) |

subsidy path for pathways III FE to CES via ES | |

| pm_tau_fe_tax_ES_st (tall, all_regi, all_esty) |

tax path for pathways III FE to CES via ES |

Realizations

(A) off

Limitations There are no known limitations.

(B) on

The bioenergy tax is calculated: it scales linearly with the bioenergy demand starting at 0 at 0EJ to the level defined in cm_bioenergy_tax at 200 EJ.

\[\begin{multline*} v21\_tau\_bio(t) = \frac{ cm\_bioenergy\_tax }{ \left(200 \cdot sm\_EJ\_2\_TWa\right) } \cdot \left(\sum_{regi}\left(vm\_fuExtr(t,regi,"pebiolc","1") + pm\_fuExtrForeign(t,regi,"pebiolc","1")\right)\right) \end{multline*}\]

Calculation of the value of the overall tax revenue vm_taxrev, that is included in the qm_budget equation. Overall tax revenue is the sum of various components which are calculated in the following equations, each of those with similar structure: The tax revenue is the difference between the product of an activity level (a variable) and a tax rate (a parameter), and this product in the last iteration (which is loaded as a parameter). After converging Negishi/Nash iterations, the value approaches 0, as the activity levels between the current and last iteration don’t change anymore. This means, taxes are budget-neutral: the revenue is always recycled back and still available for the economy. Nevertheless, the marginal of the (variable of) taxed activities is impacted by the tax which leads to the adjustment effect.

\[\begin{multline*} vm\_taxrev(t,regi) \geq v21\_taxrevGHG(t,regi) + v21\_taxrevCO2luc(t,regi) + v21\_taxrevCCS(t,regi) + v21\_taxrevNetNegEmi(t,regi) + v21\_taxrevFEtrans(t,regi) + v21\_taxrevFEBuildInd(t,regi) + v21\_taxrevFE\_Es(t,regi) + v21\_taxrevResEx(t,regi) + v21\_taxrevPE2SE(t,regi) + v21\_taxrevXport(t,regi) + v21\_taxrevSO2(t,regi) + v21\_taxrevBio(t,regi) - vm\_costSubsidizeLearning(t,regi) + v21\_implicitDiscRate(t,regi) \end{multline*}\]

Calculation of greenhouse gas taxes: tax rate (combination of 3 components) times ghg emissions Documentation of overall tax approach is above at q21_taxrev.

\[\begin{multline*} v21\_taxrevGHG(t,regi) \geq \left( pm\_taxCO2eq(t,regi) + pm\_taxCO2eqSCC(t,regi) + pm\_taxCO2eqHist(t,regi)\right) \cdot \left(vm\_co2eq(t,regi) - vm\_emiMacSector(t,regi,"co2luc")\$\left(cm\_multigasscen ne 3\right)\right) - p21\_taxrevGHG0(t,regi) \end{multline*}\]

Calculation of greenhouse gas taxes: tax rate (combination of 3 components) times land use co2 emissions Documentation of overall tax approach is above at q21_taxrev.

\[\begin{multline*} v21\_taxrevCO2luc(t,regi) \geq \left( pm\_taxCO2eq(t,regi) + pm\_taxCO2eqSCC(t,regi) + pm\_taxCO2eqHist(t,regi)\right) \cdot cm\_cprice\_red\_factor \cdot vm\_emiMacSector(t,regi,"co2luc")\$\left(cm\_multigasscen ne 3\right) - p21\_taxrevCO2LUC0(t,regi) \end{multline*}\]

Calculation of CCS tax: tax rate (defined as fraction(or multiplier) of O&M costs) times amount of CO2 sequestration Documentation of overall tax approach is above at q21_taxrev.

\[\begin{multline*} v21\_taxrevCCS(t,regi) \geq cm\_frac\_CCS \cdot pm\_data(regi,"omf","ccsinje") \cdot pm\_inco0\_t(t,regi,"ccsinje") \cdot \left( \sum_{teCCS2rlf(te,rlf)}\left( \sum_{ccs2te\left(ccsCO2(enty),enty2,te\right)} vm\_co2CCS(t,regi,enty,enty2,te,rlf) \right) \right) \cdot \left(\frac{1}{sm\_ccsinjecrate}\right) \cdot \frac{ \sum_{teCCS2rlf(te,rlf)}\left( \sum_{ccs2te\left(ccsCO2(enty),enty2,te\right)} vm\_co2CCS(t,regi,enty,enty2,te,rlf) \right) }{ pm\_dataccs(regi,"quan","1") !! fraction of injection constraint per year }- p21\_taxrevCCS0(t,regi) \end{multline*}\]

Calculation of net-negative emissions tax: tax rate (defined as fraction of carbon price) times net-negative emissions Documentation of overall tax approach is above at q21_taxrev.

\[\begin{multline*} v21\_taxrevNetNegEmi(t,regi) \geq cm\_frac\_NetNegEmi \cdot pm\_taxCO2eq(t,regi) \cdot v21\_emiALLco2neg(t,regi) - p21\_taxrevNetNegEmi0(t,regi) \end{multline*}\]

Auxiliary calculation of net-negative emissions: v21_emiAllco2neg and v21_emiAllco2neg_slack are defined as positive variables so as long as vm_emiAll is positive, v21_emiAllco2neg_slack adjusts so that sum is zero if vm_emiAll is negative, in order to minimize tax v21_emiAllco2neg_slack becomes zero

\[\begin{multline*} v21\_emiALLco2neg(t,regi) = -vm\_emiAll(t,regi,"co2") + v21\_emiALLco2neg\_slack(t,regi) \end{multline*}\]

Calculation of final Energy taxes in Transports: effective tax rate (tax - subsidy) times FE use in transport Documentation of overall tax approach is above at q21_taxrev.

\[\begin{multline*} v21\_taxrevFEtrans(t,regi) \geq SUM\left(feForEs(enty), \left(p21\_tau\_fe\_tax\_transport(t,regi,feForEs) + p21\_tau\_fe\_sub\_transport(t,regi,feForEs) \right) \cdot SUM\left(se2fe(enty2,enty,te), vm\_prodFe(t,regi,enty2,enty,te)\right) \right) + SUM\left(feForUe(enty), \left(p21\_tau\_fe\_tax\_transport(t,regi,feForUe) + p21\_tau\_fe\_sub\_transport(t,regi,feForUe) \right) \cdot SUM\left(se2fe(enty2,enty,te), vm\_prodFe(t,regi,enty2,enty,te)\right) \right) - p21\_taxrevFEtrans0(t,regi) \end{multline*}\]

Calculation of final Energy taxes in Buildings_Industry or Stationary: effective tax rate (tax - subsidy) times FE use in sector Documentation of overall tax approach is above at q21_taxrev.

\[\begin{multline*} v21\_taxrevFEBuildInd(t,regi) \geq SUM\left(ppfen(in)\$\left( NOT ppfenFromUe(in)\right), \left(p21\_tau\_fe\_tax\_bit\_st(t,regi,ppfen) + p21\_tau\_fe\_sub\_bit\_st(t,regi,ppfen) \right) \cdot vm\_cesIO(t,regi,ppfen) \right) - p21\_taxrevFEBuildInd0(t,regi) \end{multline*}\]

Calculation of final Energy taxes in Buildings_Industry or Stationary sector with energy service representation: effective tax rate (tax - subsidy) times FE use in sector Documentation of overall tax approach is above at q21_taxrev.

\[\begin{multline*} v21\_taxrevFE\_Es(t,regi) \geq SUM\left(fe2es(entyFe,esty,teEs), \left(pm\_tau\_fe\_tax\_ES\_st(t,regi,esty) + pm\_tau\_fe\_sub\_ES\_st(t,regi,esty) \right) \cdot vm\_demFeForEs(t,regi,entyFe,esty,teEs) \right) - p21\_taxrevFE\_Es0(t,regi) \end{multline*}\]

Calcuation of ressource extraction subsidies: subsidy rate times fuel extraction Documentation of overall tax approach is above at q21_taxrev.

\[\begin{multline*} v21\_taxrevResEx(t,regi) \geq \sum_{pe2rlf\left(peEx(enty),rlf\right)}\left( p21\_tau\_fuEx\_sub(t,regi,enty) \cdot vm\_fuExtr(t,regi,enty,rlf)\right) - p21\_taxrevResEx0(t,regi) \end{multline*}\]

Calculation of pe2se taxes (Primary to secondary energy technology taxes, specified by technology): effective tax rate (tax - subsidy) times SE output of technology Documentation of overall tax approach is above at q21_taxrev.

\[\begin{multline*} v21\_taxrevPE2SE(t,regi) \geq SUM\left(pe2se(enty,enty2,te), \left(p21\_tau\_pe2se\_tax(t,regi,te) + p21\_tau\_pe2se\_sub(t,regi,te) + p21\_tau\_pe2se\_inconv(t,regi,te)\right) \cdot vm\_prodSe(t,regi,enty,enty2,te) \right) - p21\_taxrevPE2SE0(t,regi) \end{multline*}\]

Calculation of export taxes: tax rate times export volume Documentation of overall tax approach is above at q21_taxrev.

\[\begin{multline*} v21\_taxrevXport(t,regi) \geq SUM\left(tradePe(enty), p21\_tau\_XpRes\_tax(t,regi,enty) \cdot vm\_Xport(t,regi,enty)\right) - p21\_taxrevXport0(t,regi) \end{multline*}\]

Calculation of so2 tax: tax rate times emissions Documentation of overall tax approach is above at q21_taxrev.

\[\begin{multline*} v21\_taxrevSO2(t,regi) \geq p21\_tau\_so2\_tax(t,regi) \cdot vm\_emiTe(t,regi,"so2") - p21\_taxrevSO20(t,regi) \end{multline*}\]

Calculation of bioenergy tax: tax rate (calculated as multiple of bioenergy price) times PE use of pebiolc Documentation of overall tax approach is above at q21_taxrev.

\[\begin{multline*} v21\_taxrevBio(t,regi) \geq v21\_tau\_bio(t) \cdot vm\_fuExtr(t,regi,"pebiolc","1") \cdot vm\_pebiolc\_price(t,regi) - p21\_taxrevBio0(t,regi) \end{multline*}\]

Calculation of High implicit discount rates in energy efficiency capital which is also modeled as a tax to mirror the lack of incentive for cost-efficient renovations. calculation is done via additional discount rate times input of capital at different levels

\[\begin{multline*} v21\_implicitDiscRate(t,regi) \geq \sum_{ppfKap(in)}\left( p21\_implicitDiscRateMarg(t,regi,in) \cdot vm\_cesIO(t,regi,in) \right) - p21\_implicitDiscRate0(t,regi) \end{multline*}\]

Limitations There are no known limitations.

Definitions

Objects

| Description | Unit | A | B | |

|---|---|---|---|---|

| f21_max_fe_sub (tall, all_regi, all_in) |

maximum final energy subsidy levels (in $/Gj) from REMIND version prior to rev. 5429 | x | ||

| f21_max_pe_sub (tall, all_regi, all_enty) |

maximum primary energy subsidy levels (in \(/Gj) to provide plausible upper bound: 40\)/barrel ~ 8 $/GJ | x | ||

| f21_prop_fe_sub (tall, all_regi, all_in) |

subsidy proportional cap to avoid liquids increasing dramatically | x | ||

| f21_tau_fe_sub_bit_st (tall, all_regi, all_in) |

2005 subsidy for stationary/buildings_industry final energy | x | ||

| f21_tau_fe_sub_transport (tall, all_regi, all_enty) |

2005 subsidy for transport final energy | x | ||

| f21_tau_fe_tax_bit_st (tall, all_regi, all_in) |

2005 tax for stationary/buildings_industry final energy | x | ||

| f21_tau_fe_tax_transport (tall, all_regi, all_enty) |

2005 tax for transport final energy | x | ||

| f21_tax_convergence (tall, all_regi, all_enty) |

Tax convergence level for specific regions, year and final energy type | x | ||

| f21_taxCO2eqHist (ttot, all_regi) |

historic CO2 prices ($/tCO2) | x | ||

| p21_deltarev (iteration, all_regi) |

convergence criteria for iteration on tax revenue recycling | x | ||

| p21_emiALLco2neg0 (ttot, all_regi) |

reference level value of negative CO2 emissions for taxes | x | ||

| p21_implicitDiscRate_iter (iteration, ttot, all_regi) |

reference level value of implicit tax on energy efficient capital | x | ||

| p21_implicitDiscRate0 (ttot, all_regi) |

reference level value of implicit tax on energy efficient capital | x | ||

| p21_implicitDiscRateMarg (ttot, all_regi, all_in) |

Difference between the normal discount rate and the implicit discount rate | x | ||

| p21_max_fe_sub (tall, all_regi, all_in) |

maximum final energy subsidy levels (in $/Gj) from REMIND version prior to rev. 5429 | x | ||

| p21_max_fe_subEs (tall, all_regi, all_esty) |

maximum final energy subsidy levels (in $/Gj) from REMIND version prior to rev. 5429 | x | ||

| p21_prop_fe_sub (tall, all_regi, all_in) |

subsidy proportional cap to avoid liquids increasing dramatically | x | ||

| p21_prop_fe_subEs (tall, all_regi, all_esty) |

subsidy proportional cap to avoid liquids increasing dramatically | x | ||

| p21_tau_bioenergy_tax (ttot) |

linearly over time increasing tax on bioenergy emulator price | x | ||

| p21_tau_CO2_tax_gdx (ttot, all_regi) |

tax path from gdx, may overwrite default values | x | ||

| p21_tau_CO2_tax_gdx_bau (ttot, all_regi) |

tax path from gdx, may overwrite default values | x | ||

| p21_tau_fe_sub_bit_st (tall, all_regi, all_in) |

subsidy path for stationary/buildings_industry final energy | x | ||

| p21_tau_fe_sub_transport (tall, all_regi, all_enty) |

subsidy path for transport final energy | x | ||

| p21_tau_fe_tax_bit_st (tall, all_regi, all_in) |

tax path for stationary/buildings_industry final energy | x | ||

| p21_tau_fe_tax_transport (tall, all_regi, all_enty) |

tax path for transport final energy | x | ||

| p21_tau_fuEx_sub (tall, all_regi, all_enty) |

2005 subsidy for fuel extraction | x | ||

| p21_tau_pe2se_inconv (tall, all_regi, all_te) |

inconvenience cost path for primary energy technologies | x | ||

| p21_tau_pe2se_sub (tall, all_regi, all_te) |

subsidy path for primary energy technologies | x | ||

| p21_tau_pe2se_tax (tall, all_regi, all_te) |

tax path for primary energy technologies | x | ||

| p21_tau_so2_tax (tall, all_regi) |

so2 tax path | x | ||

| p21_tau_xpres_tax (tall, all_regi, all_enty) |

tax path for ressource export | x | ||

| p21_taxrevBio_iter (iteration, ttot, all_regi) |

reference level value of bioenergy tax revenue | x | ||

| p21_taxrevBio0 (ttot, all_regi) |

reference level value of bioenergy tax | x | ||

| p21_taxrevCCS_iter (iteration, ttot, all_regi) |

reference level value of CCS tax revenue | x | ||

| p21_taxrevCCS0 (ttot, all_regi) |

reference level value of CCS tax | x | ||

| p21_taxrevCO2luc0 (ttot, all_regi) |

reference level value of co2luc emission tax | x | ||

| p21_taxrevFE_Es_iter (iteration, ttot, all_regi) |

reference level value of final energy (Pathway III through ES layer) tax revenue | x | ||

| p21_taxrevFE_Es0 (ttot, all_regi) |

reference level value of final energy( Pathway III through ES layer) tax revenue | x | ||

| p21_taxrevFEBuildInd_iter (iteration, ttot, all_regi) |

reference level value of final energy buildings and industry tax revenue | x | ||

| p21_taxrevFEBuildInd0 (ttot, all_regi) |

reference level value of final energy buildings and industry tax | x | ||

| p21_taxrevFEtrans_iter (iteration, ttot, all_regi) |

reference level value of final energy transport tax revenue | x | ||

| p21_taxrevFEtrans0 (ttot, all_regi) |

reference level value of final energy transport tax | x | ||

| p21_taxrevGHG_iter (iteration, ttot, all_regi) |

reference level value of GHG emission tax revenue | x | ||

| p21_taxrevGHG0 (ttot, all_regi) |

reference level value of GHG emission tax | x | ||

| p21_taxrevNetNegEmi_iter (iteration, ttot, all_regi) |

reference level value of net-negative emissions tax revenue | x | ||

| p21_taxrevNetNegEmi0 (ttot, all_regi) |

reference level value of net-negative emissions tax | x | ||

| p21_taxrevPE2SE_iter (iteration, ttot, all_regi) |

reference level value of pe2se technologies tax revenue | x | ||

| p21_taxrevPE2SE0 (ttot, all_regi) |

reference level value of pe2se technologies tax | x | ||

| p21_taxrevResEx_iter (iteration, ttot, all_regi) |

reference level value of resource extraction tax revenue | x | ||

| p21_taxrevResEx0 (ttot, all_regi) |

reference level value of resource extraction tax | x | ||

| p21_taxrevSO2_iter (iteration, ttot, all_regi) |

reference level value of SO2 tax revenue | x | ||

| p21_taxrevSO20 (ttot, all_regi) |

reference level value of SO2 tax | x | ||

| p21_taxrevXport_iter (iteration, ttot, all_regi) |

reference level value of exports tax revenue | x | ||

| p21_taxrevXport0 (ttot, all_regi) |

reference level value of exports tax | x | ||

| q21_emiAllco2neg (ttot, all_regi) |

calculates negative part of CO2 emissions | x | ||

| q21_implicitDiscRate (ttot, all_regi) |

calculation of the implicit discount rate on energy efficiency capital | x | ||

| q21_tau_bio (ttot) |

calculation of demand-dependent bioenergy tax | x | ||

| q21_taxrev (ttot, all_regi) |

calculation of difference in tax volume | x | ||

| q21_taxrevBio (ttot, all_regi) |

calculation of tax on bioenergy | x | ||

| q21_taxrevCCS (ttot, all_regi) |

calculation of tax on CCS | x | ||

| q21_taxrevCO2luc (ttot, all_regi) |

calculation of tax on co2luc emissions | x | ||

| q21_taxrevFE_Es (ttot, all_regi) |

calculation of tax on final energy going through ES layer - Pathway III | x | ||

| q21_taxrevFEBuildInd (ttot, all_regi) |

calculation of tax on final energy buildings and industry - Pathway I | x | ||

| q21_taxrevFEtrans (ttot, all_regi) |

calculation of tax on final energy transport | x | ||

| q21_taxrevGHG (ttot, all_regi) |

calculation of tax on greenhouse gas emissions | x | ||

| q21_taxrevNetNegEmi (ttot, all_regi) |

calculation of tax on net-negative emissions | x | ||

| q21_taxrevPE2SE (ttot, all_regi) |

calculation of tax on pe2se technologies | x | ||

| q21_taxrevResEx (ttot, all_regi) |

calculation of tax on resource extraction | x | ||

| q21_taxrevSO2 (ttot, all_regi) |

calculation of tax on SO2 | x | ||

| q21_taxrevXport (ttot, all_regi) |

calculation of tax on exports | x | ||

| s21_so2_tax_2010 | SO2 tax value in 2010 in 10^12$/TgS = 10^6 $/t S | x | ||

| s21_tax_time | time when final tax level is reached | x | ||

| s21_tax_value | target level of tax, sub, inconv in $/GJ, must always be rescaled after setting | x | ||

| v21_emiALLco2neg (ttot, all_regi) |

negative part of total CO2 emissions | x | ||

| v21_emiALLco2neg_slack (ttot, all_regi) |

dummy variable to extract negatice CO2 emissions from emiAll | x | ||

| v21_implicitDiscRate (ttot, all_regi) |

implicit tax on energy efficient capital | x | ||

| v21_tau_bio (ttot) |

demand-dependent bioenergy tax | x | ||

| v21_taxrevBio (ttot, all_regi) |

tax on bioenergy (to reflect sustainability constraints on bioenergy production) | x | ||

| v21_taxrevCCS (ttot, all_regi) |

tax on CCS (to reflect leakage risk) | x | ||

| v21_taxrevCO2luc (ttot, all_regi) |

tax on co2luc emissions | x | ||

| v21_taxrevFE_Es (ttot, all_regi) |

tax on final energy going through ES layer - Pathway III | x | ||

| v21_taxrevFEBuildInd (ttot, all_regi) |

tax on final energy buildings and industry (to reflect the different final energy taxes/subsidies in industry and buildings) | x | ||

| v21_taxrevFEtrans (ttot, all_regi) |

tax on final energy transport (?) | x | ||

| v21_taxrevGHG (ttot, all_regi) |

tax on greenhouse gas emissions | x | ||

| v21_taxrevNetNegEmi (ttot, all_regi) |

tax on net-negative emissions (to reflect climate damages due to overshoot) | x | ||

| v21_taxrevPE2SE (ttot, all_regi) |

tax on pe2se technologies (?) | x | ||

| v21_taxrevResEx (ttot, all_regi) |

tax on resource extraction (?) | x | ||

| v21_taxrevSO2 (ttot, all_regi) |

tax on SO2 (to reflect health impacts) | x | ||

| v21_taxrevXport (ttot, all_regi) |

tax on exports (?) | x |

Sets

| description | |

|---|---|

| all_enty | all types of quantities |

| all_esty | energy services |

| all_in | all inputs and outputs of the CES function |

| all_regi | all regions |

| all_te | all energy technologies, including from modules |

| all_teEs | energy service technologies |

| ccs2te(all_enty, all_enty, all_te) | chain for ccs |

| char | characteristics of technologies |

| enty(all_enty) | all types of quantities |

| entyFe(all_enty) | final energy types. Calculated in sets_calculations |

| esty(all_esty) | energy service types. Have to be added by modules. |

| fe_tax_sub_sbi(all_in, all_in) | correspondence between tax and subsidy input data resolution and model sectoral resolution. For FE which takes the pathway I to the CES |

| fe_tax_subEs(all_in, all_esty) | correspondence between tax and subsidy input data resolution and model sectoral resolution. For FE which takes the pathway III to the CES |

| fe2es(all_enty, all_esty, all_teEs) | map FE carriers to ES via ES technologies |

| feForEs(all_enty) | final energy types that are transformed into final energys - is filled automatically from the content of fe2es |

| feForUe(all_enty) | final energy types that are transformed into useful energys - is filled automatically from the content of fe2ue |

| in(all_in) | All inputs and outputs of the CES function |

| iteration | iterator for main (Negishi/Nash) iterations |

| modules | all the available modules |

| pe2rlf(all_enty, rlf) | map exhaustible energy to grades for qm_fuel2pe |

| pe2se(all_enty, all_enty, all_te) | map primary energy carriers to secondary |

| peEx(all_enty) | exhaustible primary energy carriers |

| ppfenFromUe(all_in) | all ppfEn that are equivalent to UE - is filled automatically from the content of fe2ue |

| ppfKap(all_in) | Primary production factors capital |

| regi(all_regi) | all regions used in the solution process |

| rlf | cost levels of fossil fuels |

| se2fe(all_enty, all_enty, all_te) | map secondary energy to end-use energy using a technology |

| t(ttot) | modeling time, usually starting in 2005, but later for fixed delay runs |

| tall | time index |

| te(all_te) | energy technologies |

| teCCS2rlf(all_te, rlf) | mapping for CCS technologies to grades |

| teEs(all_teEs) | ES technologies which are actually used (to be filled by module realizations). |

| tradePe(all_enty) | Traded primary energy commodities |

| ttot(tall) | time index with spin up |

Authors

See Also

01_macro, 24_trade, 36_buildings, 80_optimization, core