The tax module includes different types of taxes or ignores all taxes.

| Description | Unit | A | B | |

|---|---|---|---|---|

| cm_bioenergy_tax | level of bioenergy sustainability tax in fraction of bioenergy price | x | ||

| cm_BioImportTax_EU | factor for EU bioenergy import tax | x | ||

| cm_CO2TaxSectorMarkup | CO2 tax markup in buildings or transport sector, a value of 0.5 means CO2 tax increased by 50% | x | ||

| cm_cprice_red_factor | reduction factor for price on co2luc when calculating the revenues. Replicates the reduction applied in MAgPIE | x | ||

| cm_DiscRateScen | Scenario for the implicit discount rate applied to the energy efficiency capital | x | ||

| cm_emiscen | policy scenario choice | x | ||

| cm_FEtax_trajectory_abs | switch for setting the aboslute FE tax level explicitly from a given year onwards, before tax levels increases or decreases linearly to that value | x | ||

| cm_FEtax_trajectory_rel | factor for scaling the FE tax level relative to cm_startyear from a given year onwards, before tax levels increases or decreases linearly to that value | x | ||

| cm_fetaxscen | choice of final energy tax path, subsidy path and inconvenience cost path, values other than 0 make setting module 21_tax on | x | ||

| cm_frac_CCS | tax on CCS to reflect risk of leakage, formulated as fraction of ccs O&M costs | x | ||

| cm_frac_NetNegEmi | tax on CDR to reflect risk of overshooting, formulated as fraction of carbon price | x | ||

| cm_gdximport_target | whether or not the starting value for iteratively adjusted budgets, tax scenarios, or forcing targets (emiscen 5,6,8,9) should be read in from the input.gdx | x | ||

| cm_multigasscen | scenario on GHG portfolio to be included in permit trading scheme | x | ||

| cm_so2tax_scen | level of SO2 tax | x | ||

| cm_startyear | first optimized modelling time step | \(year\) | x | |

| pm_ccsinjecrate (all_regi) |

Regional CCS injection rate factor. 1/a. | x | ||

| pm_data (all_regi, char, all_te) |

Large array for most technical parameters of technologies; more detail on the individual technical parameters can be found in the declaration of the set ‘char’ | x | ||

| pm_dataccs (all_regi, char, rlf) |

maximum CO2 storage capacity using CCS technology. | \(GtC\) | x | |

| pm_fuExtrForeign (ttot, all_regi, all_enty, rlf) |

foreign fuel extraction | x | ||

| pm_gdp_gdx (tall, all_regi) |

GDP path from gdx, updated iteratively. | x | ||

| pm_inco0_t (ttot, all_regi, all_te) |

New inco0 that is time-dependent for some technologies. | \(T\$/TW\) | x | |

| pm_pop (tall, all_regi) |

population data | \(bn people\) | x | |

| pm_pvp (ttot, all_enty) |

Price on commodity markets | x | ||

| pm_tau_fe_sub (ttot, all_regi, emi_sectors, all_enty) |

subsidy path for final energy | x | ||

| pm_tau_fe_tax (ttot, all_regi, emi_sectors, all_enty) |

tax path for final energy | x | ||

| pm_taxCO2eq (ttot, all_regi) |

CO2 tax path in T$/GtC = $/kgC. To get $/tCO2, multiply with 272 | \(T\$/GtC\) | x | |

| pm_taxCO2eqHist (ttot, all_regi) |

Historic CO2 tax path in 2010 and 2015 (also in BAU!) in T$/GtC = $/kgC. To get $/tCO2, multiply with 272 | \(T\$/GtC\) | x | |

| pm_taxCO2eqRegi (tall, all_regi) |

additional regional CO2 tax path in T$/GtC = $/kgC. To get $/tCO2, multiply with 272 | \(T\$/GtC\) | x | |

| pm_taxCO2eqSCC (ttot, all_regi) |

carbon tax component due to damages (social cost of carbon) | x | ||

| pm_taxCO2eqSum (tall, all_regi) |

sum of pm_taxCO2eq, pm_taxCO2eqRegi, pm_taxCO2eqHist, pm_taxCO2eqSCC in T$/GtC = $/kgC. To get $/tCO2, multiply with 272 | \(T\$/GtC\) | x | |

| pm_taxemiMkt (ttot, all_regi, all_emiMkt) |

CO2 or CO2eq region and emission market specific emission tax | x | ||

| pm_ts (tall) |

(t_n+1 - t_n-1)/2 for a timestep t_n | x | ||

| pm_ttot_val (ttot) |

value of ttot set element | x | ||

| sm_DpGJ_2_TDpTWa | multipl. factor to convert (Dollar per GJoule) to (TerraDollar per TWyear) | x | ||

| sm_DptCO2_2_TDpGtC | Conversion multiplier to go from \(/tCO2 to T\)/GtC: 44/12/1000 | x | ||

| sm_EJ_2_TWa | multiplicative factor to convert from EJ to TWa | x | ||

| sm_eps | small number: 1e-9 | x | ||

| sm_TWa_2_MWh | tera Watt year to Mega Watt hour | x | ||

| vm_cesIO (tall, all_regi, all_in) |

Production factor | x | ||

| vm_co2CCS (ttot, all_regi, all_enty, all_enty, all_te, rlf) |

all differenct ccs. | \(GtC/a\) | x | |

| vm_co2eq (ttot, all_regi) |

total emissions measured in co2 equivalents ATTENTION: content depends on multigasscen. | \(GtCeq\) | x | |

| vm_co2eqMkt (ttot, all_regi, all_emiMkt) |

total emissions per market measured in co2 equivalents ATTENTION: content depends on multigasscen. | \(GtCeq\) | x | |

| vm_costSubsidizeLearning (ttot, all_regi) |

regional cost of subsidy for learning technologies | x | ||

| vm_deltaCap (tall, all_regi, all_te, rlf) |

capacity additions | x | ||

| vm_demFeSector (ttot, all_regi, all_enty, all_enty, emi_sectors, all_emiMkt) |

fe demand per sector and emission market. | \(TWa\) | x | |

| vm_demSe (ttot, all_regi, all_enty, all_enty, all_te) |

se demand. | \(TWa\) | x | |

| vm_emiAll (ttot, all_regi, all_enty) |

total regional emissions. | \(GtC, Mt CH4, Mt N\) | x | |

| vm_emiCO2Sector (ttot, all_regi, emi_sectors) |

total CO2 emissions from individual sectors | \(GtC\) | x | |

| vm_emiMac (ttot, all_regi, all_enty) |

total non-energy-related emission of each region. | \(GtC, Mt CH4, Mt N\) | x | |

| vm_emiMacSector (ttot, all_regi, all_enty) |

total non-energy-related emission of each region. | \(GtC, Mt CH4, Mt N\) | x | |

| vm_emiTe (ttot, all_regi, all_enty) |

total energy-related emissions of each region. | \(GtC, Mt CH4, Mt N\) | x | |

| vm_flexAdj (tall, all_regi, all_te) |

flexibility adjustment used for flexibility subsidy (tax) to emulate price changes of technologies which see lower-than-average (higher-than-average) elec. prices | \(trUSD/TWa\) | x | |

| vm_fuExtr (ttot, all_regi, all_enty, rlf) |

fuel use | \(TWa\) | x | |

| vm_Mport (tall, all_regi, all_enty) |

Import of traded commodity. | x | ||

| vm_pebiolc_price (ttot, all_regi) |

Bioenergy price according to MAgPIE supply curves | \(T\$US/TWa\) | x | |

| vm_prodPe (ttot, all_regi, all_enty) |

pe production. | \(TWa, Uranium: Mt Ur\) | x | |

| vm_prodSe (tall, all_regi, all_enty, all_enty, all_te) |

se production. | \(TWa\) | x | |

| vm_taxrev (ttot, all_regi) |

difference between tax volume in current and previous iteration | x | x | |

| vm_taxrevimplFETax (ttot, all_regi) |

implicit efficiency directive target tax | x | ||

| vm_Xport (tall, all_regi, all_enty) |

Export of traded commodity. | x |

| Description | Unit | |

|---|---|---|

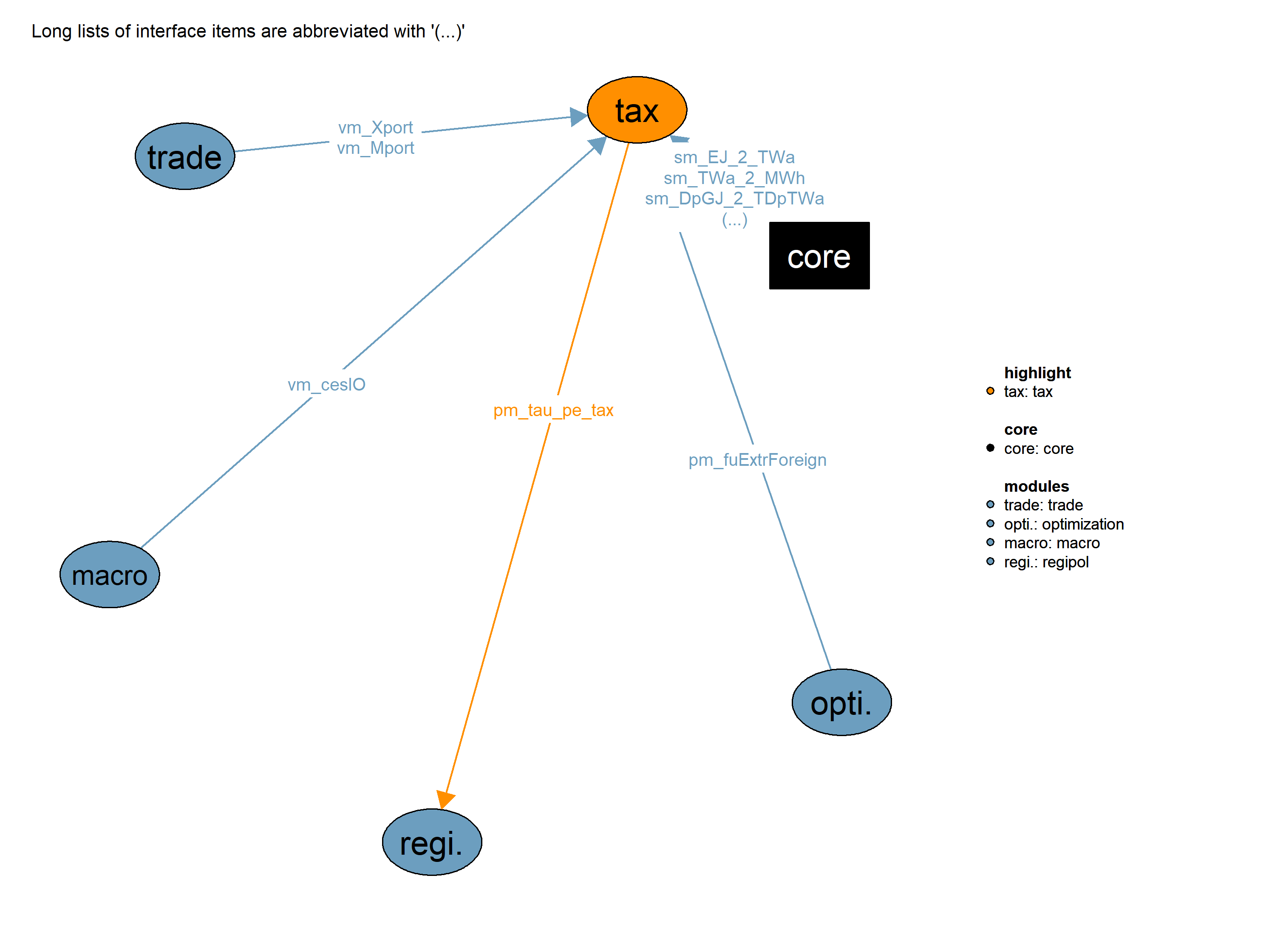

| pm_tau_pe_tax (ttot, all_regi, all_enty) |

pe tax path |

Limitations There are no known limitations.

The bioenergy tax is calculated: it scales linearly with the bioenergy demand starting at 0 at 0EJ to the level defined in cm_bioenergy_tax at 200 EJ.

\[\begin{multline*} v21\_tau\_bio(t) = \frac{ cm\_bioenergy\_tax }{ \left(200 \cdot sm\_EJ\_2\_TWa\right) } \cdot \left(\sum_{regi}\left(vm\_fuExtr(t,regi,"pebiolc","1") + pm\_fuExtrForeign(t,regi,"pebiolc","1")\right)\right) \end{multline*}\]

Calculation of the value of the overall tax revenue vm_taxrev, that is included in the qm_budget equation. Overall tax revenue is the sum of various components which are calculated in the following equations, each of those with similar structure: The tax revenue is the difference between the product of an activity level (a variable) and a tax rate (a parameter), and this product in the last iteration (which is loaded as a parameter). After converging Negishi/Nash iterations, the value approaches 0, as the activity levels between the current and last iteration don’t change anymore. This means, taxes are budget-neutral: the revenue is always recycled back and still available for the economy. Nevertheless, the marginal of the (variable of) taxed activities is impacted by the tax which leads to the adjustment effect.

q21_taxrev(t,regi)$(t.val ge max(2010,cm_startyear))..

vm_taxrev(t,regi)

=e=

v21_taxrevGHG(t,regi)

+ sum(emi_sectors, v21_taxrevCO2Sector(t,regi,emi_sectors))

+ v21_taxrevCO2luc(t,regi)

+ v21_taxrevCCS(t,regi)

+ v21_taxrevNetNegEmi(t,regi)

+ sum(entyPe, v21_taxrevPE(t,regi,entyPe))

+ v21_taxrevFE(t,regi)

+ v21_taxrevResEx(t,regi)

+ v21_taxrevPE2SE(t,regi)

+ v21_taxrevTech(t,regi)

+ v21_taxrevXport(t,regi)

+ v21_taxrevSO2(t,regi)

+ v21_taxrevBio(t,regi)

- vm_costSubsidizeLearning(t,regi)

+ v21_implicitDiscRate(t,regi)

+ sum(emiMkt, v21_taxemiMkt(t,regi,emiMkt))

+ v21_taxrevFlex(t,regi)

+ v21_taxrevBioImport(t,regi)

$ifthen.cm_implicitFE not "%cm_implicitFE%" == "off"

+ vm_taxrevimplFETax(t,regi)

$endif.cm_implicitFE

;Calculation of greenhouse gas taxes: tax rate (combination of 4 components) times ghg emissions Documentation of overall tax approach is above at q21_taxrev.

\[\begin{multline*} v21\_taxrevGHG(t,regi) = pm\_taxCO2eqSum(t,regi) \cdot \left(vm\_co2eq(t,regi) - vm\_emiMacSector(t,regi,"co2luc")\$\left(cm\_multigasscen ne 3\right)\right) - p21\_taxrevGHG0(t,regi) \end{multline*}\]

Calculation of sectoral CO2 taxes as markup to GHG taxes (combination of 4 components) Sectoral CO2 emissions are multiplied by a predefined factor

\[\begin{multline*} v21\_taxrevCO2Sector(t,regi,emi\_sectors) = p21\_CO2TaxSectorMarkup(regi,emi\_sectors) \cdot pm\_taxCO2eqSum(t,regi) \cdot vm\_emiCO2Sector(t,regi,emi\_sectors) - p21\_taxrevCO2Sector0(t,regi,emi\_sectors) \end{multline*}\]

Calculation of greenhouse gas taxes: tax rate (combination of 4 components) times land use co2 emissions Documentation of overall tax approach is above at q21_taxrev.

\[\begin{multline*} v21\_taxrevCO2luc(t,regi) = pm\_taxCO2eqSum(t,regi) \cdot cm\_cprice\_red\_factor \cdot vm\_emiMacSector(t,regi,"co2luc")\$\left(cm\_multigasscen ne 3\right) - p21\_taxrevCO2LUC0(t,regi) \end{multline*}\]

Calculation of CCS tax: tax rate (defined as fraction(or multiplier) of O&M costs) times amount of CO2 sequestration Documentation of overall tax approach is above at q21_taxrev.

\[\begin{multline*} v21\_taxrevCCS(t,regi) = cm\_frac\_CCS \cdot pm\_data(regi,"omf","ccsinje") \cdot pm\_inco0\_t(t,regi,"ccsinje") \cdot \left( \sum_{teCCS2rlf(te,rlf)}\left( \sum_{ccs2te\left(ccsCO2(enty),enty2,te\right)} vm\_co2CCS(t,regi,enty,enty2,te,rlf) \right) \right) \cdot \left(\frac{1}{pm\_ccsinjecrate(regi)}\right) \cdot \frac{ \sum_{teCCS2rlf(te,rlf)}\left( \sum_{ccs2te\left(ccsCO2(enty),enty2,te\right)} vm\_co2CCS(t,regi,enty,enty2,te,rlf) \right) }{ pm\_dataccs(regi,"quan","1") }- p21\_taxrevCCS0(t,regi) \end{multline*}\]

Calculation of net-negative emissions tax: tax rate (defined as fraction of carbon price) times net-negative emissions Documentation of overall tax approach is above at q21_taxrev.

\[\begin{multline*} v21\_taxrevNetNegEmi(t,regi) = cm\_frac\_NetNegEmi \cdot pm\_taxCO2eqSum(t,regi) \cdot v21\_emiALLco2neg(t,regi) - p21\_taxrevNetNegEmi0(t,regi) \end{multline*}\]

Auxiliary calculation of net-negative emissions: v21_emiAllco2neg and v21_emiAllco2neg_slack are defined as positive variables so as long as vm_emiAll is positive, v21_emiAllco2neg_slack adjusts so that sum is zero if vm_emiAll is negative, in order to minimize tax v21_emiAllco2neg_slack becomes zero

\[\begin{multline*} v21\_emiALLco2neg(t,regi) = -vm\_emiAll(t,regi,"co2") + v21\_emiALLco2neg\_slack(t,regi) \end{multline*}\]

Calculation of PE tax: tax rate times primary energy Documentation of overall tax approach is above at q21_taxrev.

\[\begin{multline*} v21\_taxrevPE(t,regi,entyPe) = pm\_tau\_pe\_tax(t,regi,entyPe) \cdot vm\_prodPe(t,regi,entyPe) - p21\_taxrevPE0(t,regi,entyPe) \end{multline*}\]

Calculation of final Energy taxes: effective tax rate (tax - subsidy) times FE use in the specific sector Documentation of overall tax approach is above at q21_taxrev.

\[\begin{multline*} v21\_taxrevFE(t,regi) = \sum_{\left(entyFe,sector\right)\$entyFe2Sector(entyFe,sector)}\left( \left( pm\_tau\_fe\_tax(t,regi,sector,entyFe) + pm\_tau\_fe\_sub(t,regi,sector,entyFe) \right) \cdot \sum_{emiMkt\$sector2emiMkt(sector,emiMkt)}\left( \sum_{se2fe(entySe,entyFe,te)}\left( vm\_demFeSector(t,regi,entySe,entyFe,sector,emiMkt) \right) \right) \right) - p21\_taxrevFE0(t,regi) \end{multline*}\]

Calculation of resource extraction subsidies: subsidy rate times fuel extraction Documentation of overall tax approach is above at q21_taxrev.

\[\begin{multline*} v21\_taxrevResEx(t,regi) = \sum_{pe2rlf\left(peEx(enty),rlf\right)}\left( p21\_tau\_fuEx\_sub(t,regi,enty) \cdot vm\_fuExtr(t,regi,enty,rlf)\right) - p21\_taxrevResEx0(t,regi) \end{multline*}\]

Calculation of pe2se taxes (Primary to secondary energy technology taxes, specified by technology): effective tax rate (tax - subsidy) times SE output of technology Documentation of overall tax approach is above at q21_taxrev.

\[\begin{multline*} v21\_taxrevPE2SE(t,regi) = SUM\left(pe2se(enty,enty2,te), \left(p21\_tau\_pe2se\_tax(t,regi,te) + p21\_tau\_pe2se\_sub(t,regi,te) + p21\_tau\_pe2se\_inconv(t,regi,te)\right) \cdot vm\_prodSe(t,regi,enty,enty2,te) \right) - p21\_taxrevPE2SE0(t,regi) \end{multline*}\]

Calculation of technology specific subsidies and taxes. Tax incidency applied only over new capacity (deltaCap) Documentation of overall tax approach is above at q21_taxrev.

\[\begin{multline*} v21\_taxrevTech(t,regi) = \sum_{te2rlf(te,rlf)}\left( \left(p21\_tech\_tax(t,regi,te,rlf) + p21\_tech\_sub(t,regi,te,rlf)\right) \cdot vm\_deltaCap(t,regi,te,rlf) \right) - p21\_taxrevTech0(t,regi) \end{multline*}\]

Calculation of export taxes: tax rate times export volume Documentation of overall tax approach is above at q21_taxrev.

\[\begin{multline*} v21\_taxrevXport(t,regi) = SUM\left(tradePe(enty), p21\_tau\_XpRes\_tax(t,regi,enty) \cdot vm\_Xport(t,regi,enty)\right) - p21\_taxrevXport0(t,regi) \end{multline*}\]

Calculation of so2 tax: tax rate times emissions Documentation of overall tax approach is above at q21_taxrev.

\[\begin{multline*} v21\_taxrevSO2(t,regi) = p21\_tau\_so2\_tax(t,regi) \cdot vm\_emiTe(t,regi,"so2") - p21\_taxrevSO20(t,regi) \end{multline*}\]

Calculation of bioenergy tax: tax rate (calculated as multiple of bioenergy price) times PE use of pebiolc Documentation of overall tax approach is above at q21_taxrev.

\[\begin{multline*} v21\_taxrevBio(t,regi) = v21\_tau\_bio(t) \cdot vm\_fuExtr(t,regi,"pebiolc","1") \cdot vm\_pebiolc\_price(t,regi) - p21\_taxrevBio0(t,regi) \end{multline*}\]

Calculation of High implicit discount rates in energy efficiency capital which is also modeled as a tax to mirror the lack of incentive for cost-efficient renovations. calculation is done via additional discount rate times input of capital at different levels

\[\begin{multline*} v21\_implicitDiscRate(t,regi) = \sum_{ppfKap(in)}\left( p21\_implicitDiscRateMarg(t,regi,in) \cdot vm\_cesIO(t,regi,in) \right) - p21\_implicitDiscRate0(t,regi) \end{multline*}\]

Calculation of specific emission market taxes calculation is done via additional budget emission constraints defined in regipol module

\[\begin{multline*} v21\_taxemiMkt(t,regi,emiMkt) = pm\_taxemiMkt(t,regi,emiMkt) \cdot vm\_co2eqMkt(t,regi,emiMkt) - p21\_taxemiMkt0(t,regi,emiMkt) \end{multline*}\]

FS: Calculation of tax/subsidy on technologies with inflexible/flexible electricity input This is to emulate the effect of lower/higher electricity prices in high VRE systems on flexible/inflexible electricity demands.

\[\begin{multline*} v21\_taxrevFlex(t,regi) = \sum_{en2en(enty,enty2,te)\$teFlexTax(te)}\left( -vm\_flexAdj(t,regi,te) \cdot vm\_demSe(t,regi,enty,enty2,te) \right) - p21\_taxrevFlex0(t,regi) \end{multline*}\]

FS: bioenergy import tax adjusts bioenergy import price, adresses sustainability concerns about the biomass world market e.g. about negative consequences of biomass supply-chains in the Global South

\[\begin{multline*} v21\_taxrevBioImport(t,regi) = p21\_tau\_BioImport(t,regi) \cdot \frac{ pm\_pvp(t,"pebiolc") }{ pm\_pvp(t,"good") } \cdot vm\_Mport(t,regi,"pebiolc") - p21\_taxrevBioImport0(t,regi) \end{multline*}\]

Limitations There are no known limitations.

| Description | Unit | A | B | |

|---|---|---|---|---|

| f21_max_fe_sub (tall, all_regi, all_enty) |

maximum final energy subsidy levels (in $/Gj) from REMIND version prior to rev. 5429 | x | ||

| f21_max_pe_sub (tall, all_regi, all_enty) |

maximum primary energy subsidy levels (in \(/Gj) to provide plausible upper bound: 40\)/barrel ~ 8 $/GJ | x | ||

| f21_prop_fe_sub (tall, all_regi, all_enty) |

subsidy proportional cap to avoid liquids increasing dramatically | x | ||

| f21_tau_fe_sub (tall, all_regi, emi_sectors, all_enty) |

2005 final energy subsidy | x | ||

| f21_tau_fe_tax (tall, all_regi, emi_sectors, all_enty) |

2005 final energy tax | x | ||

| f21_tau_fuEx_sub (tall, all_regi, all_enty) |

2005 subsidy for fuel extraction | x | ||

| f21_tax_convergence (tall, all_regi, all_enty) |

Tax convergence level for specific regions, year and final energy type | x | ||

| f21_taxCO2eqHist (ttot, all_regi) |

historic CO2 prices ($/tCO2) | x | ||

| f21_tech_sub (tall, all_regi, all_te) |

subsidy path for transport specific new capacity (BEV and FCEV) | x | ||

| p21_CO2TaxSectorMarkup (all_regi, emi_sectors) |

CO2 tax markup in building, industry or transport sector | x | ||

| p21_deltarev (iteration, all_regi) |

convergence criteria for iteration on tax revenue recycling | x | ||

| p21_emiALLco2neg0 (ttot, all_regi) |

reference level value of negative CO2 emissions for taxes | x | ||

| p21_extRegiCO2TaxSectorMarkup (ext_regi, emi_sectors) |

CO2 tax markup in building, industry or transport sector (extended regions) | x | ||

| p21_FEtax_trajectory_abs (ttot, emi_sectors, all_enty) |

absolute final energy tax level of the end year set by cm_FEtax_trajectory_abs switch | \(USD/MWh\) | x | |

| p21_FEtax_trajectory_rel (ttot, emi_sectors, all_enty) |

factor to scale final energy tax level of the end year from cm_FEtax_trajectory_rel switch | x | ||

| p21_implicitDiscRate_iter (iteration, ttot, all_regi) |

reference level value of implicit tax on energy efficient capital | x | ||

| p21_implicitDiscRate0 (ttot, all_regi) |

reference level value of implicit tax on energy efficient capital | x | ||

| p21_implicitDiscRateMarg (ttot, all_regi, all_in) |

Difference between the normal discount rate and the implicit discount rate | x | ||

| p21_max_fe_sub (tall, all_regi, all_enty) |

maximum final energy subsidy levels from REMIND version prior to rev. 5429 | \(\$/TWa\) | x | |

| p21_prop_fe_sub (tall, all_regi, all_enty) |

subsidy proportional cap to avoid liquids increasing dramatically | x | ||

| p21_tau_bioenergy_tax (ttot) |

linearly over time increasing tax on bioenergy emulator price | x | ||

| p21_tau_BioImport (ttot, all_regi) |

bioenergy import tax level | x | ||

| p21_tau_CO2_tax_gdx (ttot, all_regi) |

tax path from gdx, may overwrite default values | x | ||

| p21_tau_CO2_tax_gdx_bau (ttot, all_regi) |

tax path from gdx, may overwrite default values | x | ||

| p21_tau_fuEx_sub (tall, all_regi, all_enty) |

subsidy path for fuel extraction | \(\$/TWa\) | x | |

| p21_tau_pe2se_inconv (tall, all_regi, all_te) |

inconvenience cost path for primary energy technologies | x | ||

| p21_tau_pe2se_sub (tall, all_regi, all_te) |

subsidy path for primary energy technologies | x | ||

| p21_tau_pe2se_tax (tall, all_regi, all_te) |

tax path for primary energy technologies | x | ||

| p21_tau_so2_tax (tall, all_regi) |

so2 tax path | x | ||

| p21_tau_xpres_tax (tall, all_regi, all_enty) |

tax path for ressource export | x | ||

| p21_taxemiMkt0 (ttot, all_regi, all_emiMkt) |

reference level value of co2 emission taxes per emission market | x | ||

| p21_taxrevBio_iter (iteration, ttot, all_regi) |

reference level value of bioenergy tax revenue | x | ||

| p21_taxrevBio0 (ttot, all_regi) |

reference level value of bioenergy tax | x | ||

| p21_taxrevBioImport_iter (iteration, ttot, all_regi) |

reference level value of bioenergy import tax | x | ||

| p21_taxrevBioImport0 (ttot, all_regi) |

reference level value of bioenergy import tax | x | ||

| p21_taxrevCCS_iter (iteration, ttot, all_regi) |

reference level value of CCS tax revenue | x | ||

| p21_taxrevCCS0 (ttot, all_regi) |

reference level value of CCS tax | x | ||

| p21_taxrevCO2luc0 (ttot, all_regi) |

reference level value of co2luc emission tax | x | ||

| p21_taxrevCO2Sector0 (ttot, all_regi, emi_sectors) |

reference level value of CO2 sector markup tax | x | ||

| p21_taxrevFE_iter (iteration, ttot, all_regi) |

reference level value of final energy tax revenue | x | ||

| p21_taxrevFE0 (ttot, all_regi) |

reference level value of final energy tax | x | ||

| p21_taxrevFlex_iter (iteration, ttot, all_regi) |

reference level value of flexibility tax revenue | x | ||

| p21_taxrevFlex0 (ttot, all_regi) |

reference level value of flexibility tax | x | ||

| p21_taxrevGHG_iter (iteration, ttot, all_regi) |

reference level value of GHG emission tax revenue | x | ||

| p21_taxrevGHG0 (ttot, all_regi) |

reference level value of GHG emission tax | x | ||

| p21_taxrevNetNegEmi_iter (iteration, ttot, all_regi) |

reference level value of net-negative emissions tax revenue | x | ||

| p21_taxrevNetNegEmi0 (ttot, all_regi) |

reference level value of net-negative emissions tax | x | ||

| p21_taxrevPE_iter (iteration, ttot, all_regi, all_enty) |

reference level value of primary energy tax revenue | x | ||

| p21_taxrevPE0 (ttot, all_regi, all_enty) |

reference level value of primary energy tax | x | ||

| p21_taxrevPE2SE_iter (iteration, ttot, all_regi) |

reference level value of pe2se technologies tax revenue | x | ||

| p21_taxrevPE2SE0 (ttot, all_regi) |

reference level value of pe2se technologies tax | x | ||

| p21_taxrevResEx_iter (iteration, ttot, all_regi) |

reference level value of resource extraction tax revenue | x | ||

| p21_taxrevResEx0 (ttot, all_regi) |

reference level value of resource extraction tax | x | ||

| p21_taxrevSO2_iter (iteration, ttot, all_regi) |

reference level value of SO2 tax revenue | x | ||

| p21_taxrevSO20 (ttot, all_regi) |

reference level value of SO2 tax | x | ||

| p21_taxrevTech_iter (iteration, ttot, all_regi) |

reference level value of technology specific new capacity subsidies or taxes revenue | x | ||

| p21_taxrevTech0 (ttot, all_regi) |

reference level value of technology specific new capacity subsidies or taxes revenue | x | ||

| p21_taxrevXport_iter (iteration, ttot, all_regi) |

reference level value of exports tax revenue | x | ||

| p21_taxrevXport0 (ttot, all_regi) |

reference level value of exports tax | x | ||

| p21_tech_sub (tall, all_regi, all_te, rlf) |

subsidy path for technology specific new capacity | x | ||

| p21_tech_tax (tall, all_regi, all_te, rlf) |

tax path for technology specific new capacity | x | ||

| q21_emiAllco2neg (ttot, all_regi) |

calculates negative part of CO2 emissions | x | ||

| q21_implicitDiscRate (ttot, all_regi) |

calculation of the implicit discount rate on energy efficiency capital | x | ||

| q21_tau_bio (ttot) |

calculation of demand-dependent bioenergy tax | x | ||

| q21_taxemiMkt (ttot, all_regi, all_emiMkt) |

calculation of specific emission market tax on CO2 emissions | x | ||

| q21_taxrev (ttot, all_regi) |

calculation of difference in tax volume | x | ||

| q21_taxrevBio (ttot, all_regi) |

calculation of tax on bioenergy | x | ||

| q21_taxrevBioImport (ttot, all_regi) |

calculation of bioenergy import tax | x | ||

| q21_taxrevCCS (ttot, all_regi) |

calculation of tax on CCS | x | ||

| q21_taxrevCO2luc (ttot, all_regi) |

calculation of tax on co2luc emissions | x | ||

| q21_taxrevCO2Sector (ttot, all_regi, emi_sectors) |

calculation of sector markup tax on CO2 emissions | x | ||

| q21_taxrevFE (ttot, all_regi) |

calculation of tax on final energy | x | ||

| q21_taxrevFlex (ttot, all_regi) |

tax on technologies with flexible or inflexible electricity input | x | ||

| q21_taxrevGHG (ttot, all_regi) |

calculation of tax on greenhouse gas emissions | x | ||

| q21_taxrevNetNegEmi (ttot, all_regi) |

calculation of tax on net-negative emissions | x | ||

| q21_taxrevPE (ttot, all_regi, all_enty) |

calculation of tax on primary energy | x | ||

| q21_taxrevPE2SE (ttot, all_regi) |

calculation of tax on pe2se technologies | x | ||

| q21_taxrevResEx (ttot, all_regi) |

calculation of tax on resource extraction | x | ||

| q21_taxrevSO2 (ttot, all_regi) |

calculation of tax on SO2 | x | ||

| q21_taxrevTech (ttot, all_regi) |

calculation of technology specific new capacity subsidies or taxes | x | ||

| q21_taxrevXport (ttot, all_regi) |

calculation of tax on exports | x | ||

| s21_so2_tax_2010 | SO2 tax value in 2010 in 10^12$/TgS = 10^6 $/t S | x | ||

| s21_tax_time | time when final tax level is reached | x | ||

| s21_tax_value | target level of tax, sub, inconv in $/GJ, must always be rescaled after setting | x | ||

| v21_emiALLco2neg (ttot, all_regi) |

negative part of total CO2 emissions | x | ||

| v21_emiALLco2neg_slack (ttot, all_regi) |

dummy variable to extract negatice CO2 emissions from emiAll | x | ||

| v21_implicitDiscRate (ttot, all_regi) |

implicit tax on energy efficient capital | x | ||

| v21_tau_bio (ttot) |

demand-dependent bioenergy tax | x | ||

| v21_taxemiMkt (ttot, all_regi, all_emiMkt) |

tax on greenhouse gas emissions | x | ||

| v21_taxrevBio (ttot, all_regi) |

tax on bioenergy (to reflect sustainability constraints on bioenergy production) | x | ||

| v21_taxrevBioImport (ttot, all_regi) |

bioenergy import tax | x | ||

| v21_taxrevCCS (ttot, all_regi) |

tax on CCS (to reflect leakage risk) | x | ||

| v21_taxrevCO2luc (ttot, all_regi) |

tax on co2luc emissions | x | ||

| v21_taxrevCO2Sector (ttot, all_regi, emi_sectors) |

sector markup tax on CO2 emissions | x | ||

| v21_taxrevFE (ttot, all_regi) |

tax on final energy (?) | x | ||

| v21_taxrevFlex (ttot, all_regi) |

tax on technologies with flexible or inflexible electricity input | x | ||

| v21_taxrevGHG (ttot, all_regi) |

tax on greenhouse gas emissions | x | ||

| v21_taxrevNetNegEmi (ttot, all_regi) |

tax on net-negative emissions (to reflect climate damages due to overshoot) | x | ||

| v21_taxrevPE (ttot, all_regi, all_enty) |

tax on primary energy | x | ||

| v21_taxrevPE2SE (ttot, all_regi) |

tax on pe2se technologies (?) | x | ||

| v21_taxrevResEx (ttot, all_regi) |

tax on resource extraction (?) | x | ||

| v21_taxrevSO2 (ttot, all_regi) |

tax on SO2 (to reflect health impacts) | x | ||

| v21_taxrevTech (ttot, all_regi) |

revenue of technology specific new capacity subsidies or taxes | x | ||

| v21_taxrevXport (ttot, all_regi) |

tax on exports (?) | x |

| description | |

|---|---|

| all_emiMkt | emission markets |

| all_enty | all types of quantities |

| all_in | all inputs and outputs of the CES function |

| all_regi | all regions |

| all_te | all energy technologies, including from modules |

| ccs2te(all_enty, all_enty, all_te) | chain for ccs |

| char | characteristics of technologies |

| emi_sectors | comprehensive sector set used for more detailed emissions accounting (REMIND-EU) and for CH4 tier 1 scaling - potentially to be integrated with similar set all_exogEmi |

| en2en(all_enty, all_enty, all_te) | all energy conversion mappings |

| enty(all_enty) | all types of quantities |

| entyFe(all_enty) | final energy types. |

| entyFe2Sector(all_enty, emi_sectors) | final energy (stationary and transportation) mapping to sectors (industry, buildings, transportation and cdr) |

| entyPe(all_enty) | Primary energy types (PE) |

| entySe(all_enty) | secondary energy types |

| ext_regi | extended regions list (includes subsets of H12 regions) |

| in(all_in) | All inputs and outputs of the CES function |

| iteration | iterator for main (Negishi/Nash) iterations |

| modules | all the available modules |

| pe2rlf(all_enty, rlf) | map exhaustible energy to grades for qm_fuel2pe |

| pe2se(all_enty, all_enty, all_te) | map primary energy carriers to secondary |

| peEx(all_enty) | exhaustible primary energy carriers |

| ppfKap(all_in) | Primary production factors capital |

| regi(all_regi) | all regions used in the solution process |

| regi_group(ext_regi, all_regi) | region groups (regions that together corresponds to a H12 region) |

| rlf | cost levels of fossil fuels |

| se2fe(all_enty, all_enty, all_te) | map secondary energy to end-use energy using a technology |

| sector2emiMkt(emi_sectors, all_emiMkt) | mapping sectors to emission markets |

| set | regi_nucscen(all_regi) regions which nucscen applies to |

| t(ttot) | modeling time, usually starting in 2005, but later for fixed delay runs |

| tall | time index |

| te(all_te) | energy technologies |

| te2rlf(all_te, rlf) | all technologies to grades |

| teCCS2rlf(all_te, rlf) | mapping for CCS technologies to grades |

| teFlexTax(all_te) | all technologies to which flexibility tax/subsidy applies, flexible technologies are those in teFlex, inflexible technologies those which are not in teFlex |

| tradePe(all_enty) | Traded primary energy commodities |

| ttot(tall) | time index with spin up |

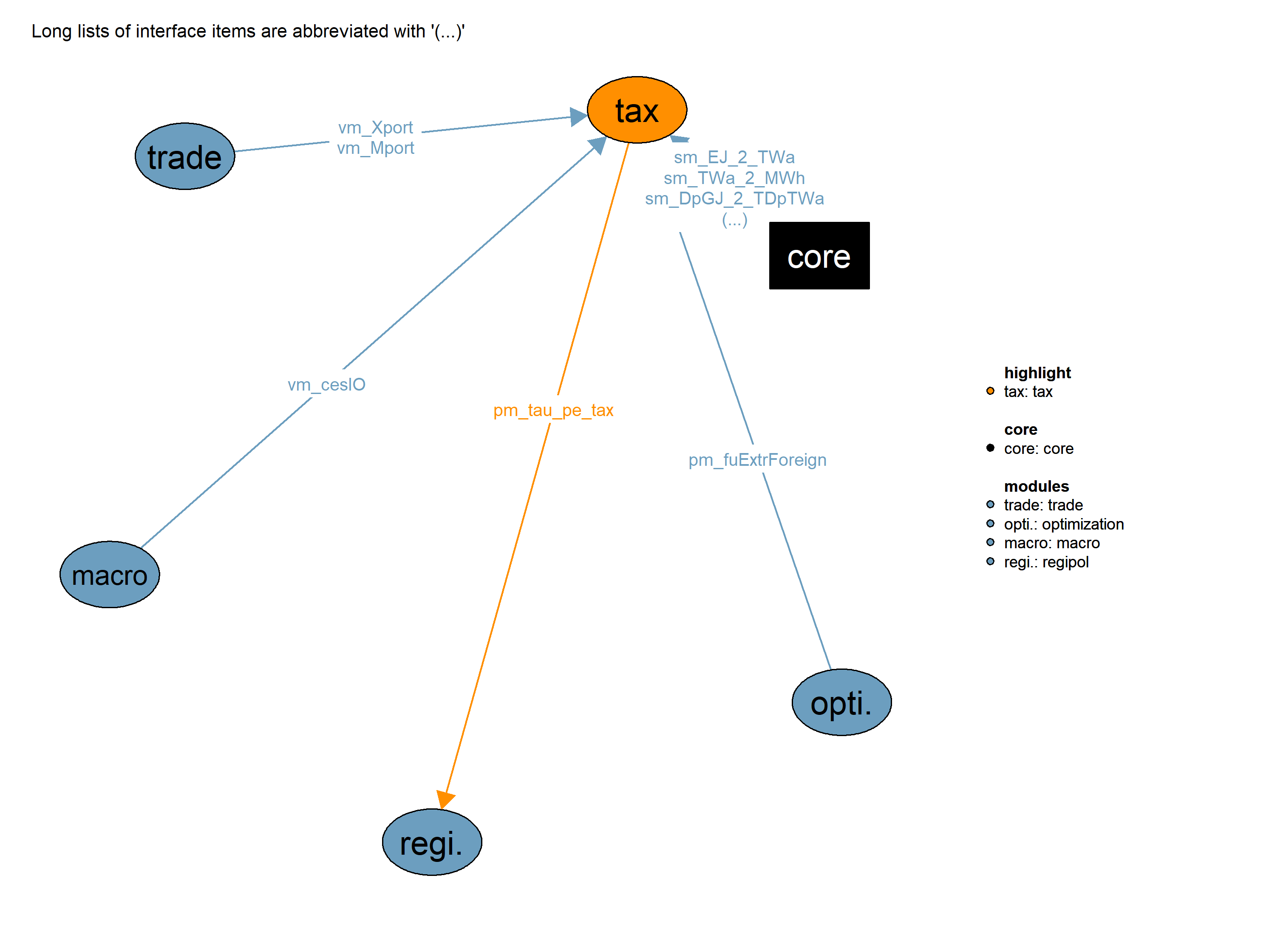

01_macro, 24_trade, 47_regipol, 80_optimization, core