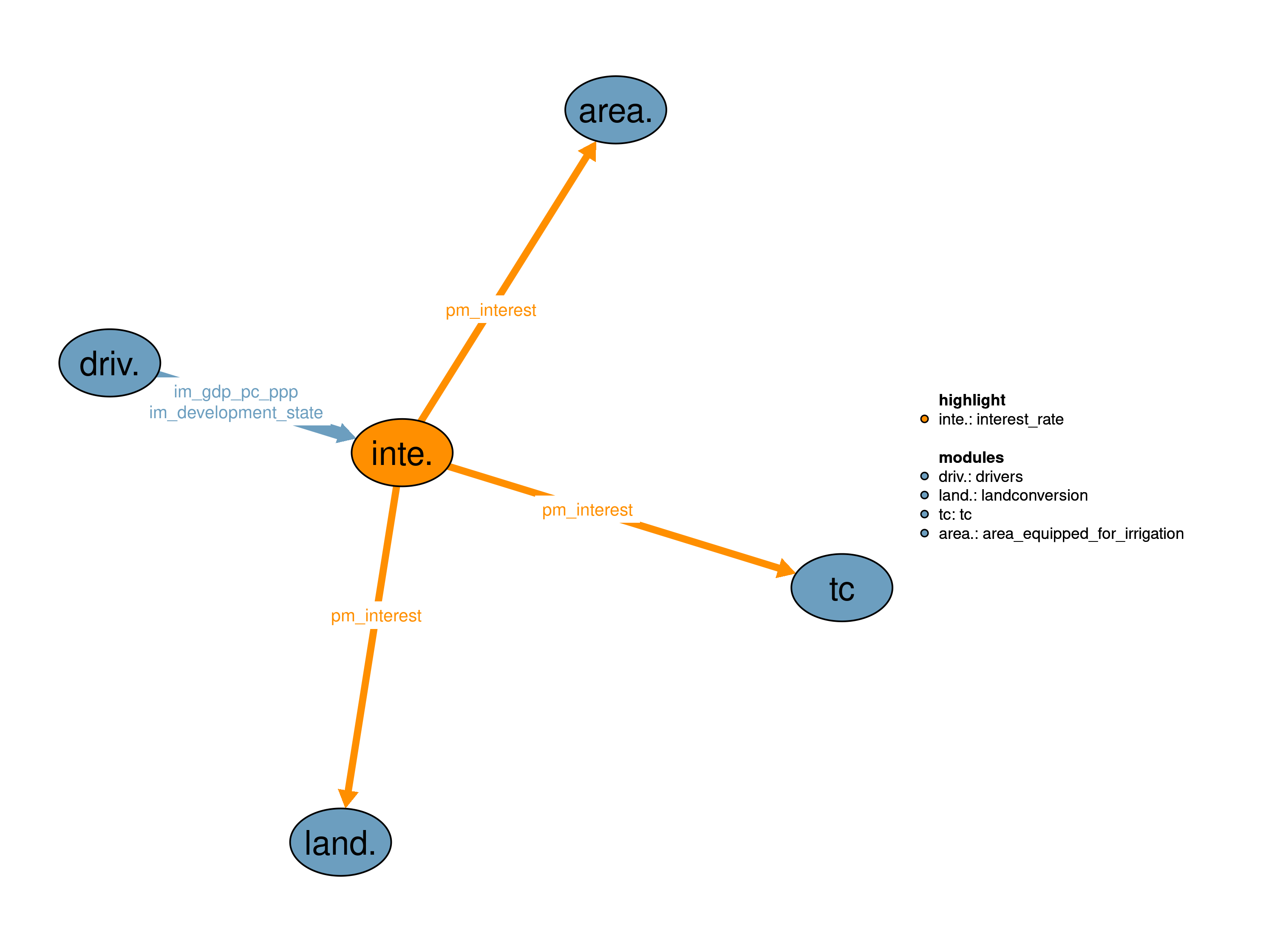

Interest rates are used in MAgPIE as a risk-accounting factor associated with investment activities (Wang et al. 2016). Interest rates are required for inter-temporal calculations in the model such as shifting investment from one time step to another or distribution of one-time investments over several time steps (e.g. in the modules 13_tc, 39_landconversion and 41_area_equipped_for_irrigation).

| Description | Unit | A | B | |

|---|---|---|---|---|

| im_development_state (t, i) |

Development state according to the World Bank definition where 0=low income country 1=high income country in high income level | \(1\) | x | |

| im_gdp_pc_ppp (t, i) |

Per capita income in purchasing power parity | \(USD_{05PPP}/cap/yr\) | x |

| Description | Unit | |

|---|---|---|

| pm_interest (i) |

Current interest rate in each region | \(\%/yr\) |

In the glo_jan16 realization, interest rates are identical in all regions. The initial global interest rate is 7% (in 1995) for all scenarios defined in scen12. It undergoes a transition towards 4%, 7% and 10% until 2030 for the low-, medium- and high- interest rate scenarios, respectively.

Limitations There are no known limitations.

The reg_feb18 realization is the default setting, in which the interest rate depends on the development state im_development_state, which is calculated based on GDP per capita. Thus, interest rates are regionally specific and dynamic over time.

s12_min_dev = smin(i,im_development_state("y1995",i));

s12_max_dev = smax(i,im_development_state("y1995",i));

s12_slope_a = (f12_interest_bound("y1995","high")-f12_interest_bound("y1995","low"))/(s12_min_dev-s12_max_dev);

s12_intercept_b = f12_interest_bound("y1995","high")-s12_slope_a*s12_min_dev;

p12_interest(t,i) = s12_slope_a *im_development_state(t,i) + s12_intercept_b;Limitations There are no known limitations.

| Description | Unit | A | B | |

|---|---|---|---|---|

| f12_interest (t_all, scen12) |

Interest rate scenarios | \(\%/yr\) | x | |

| f12_interest_bound (t, bound12) |

Lower and higher bounds of interest rates | \(\%/yr\) | x | |

| p12_interest (t, i) |

Interest rate | \(\%/yr\) | x | x |

| s12_intercept_b | Intercept of the linear relationship between development state and interest rate | \(1\) | x | |

| s12_max_dev | Maximum development_state of all regions in 1995 | \(1\) | x | |

| s12_min_dev | Minimum development_state of all regions in 1995 | \(1\) | x | |

| s12_slope_a | Slope of the linear relationship between development state and interest rate | \(1\) | x |

| description | |

|---|---|

| bound12 | Bound for interest rate |

| dev | Economic development status |

| i | World regions |

| scen12 | Interest rate scenarios |

| scen12_to_dev(scen12, dev) | Mapping between interest scneario and economic development status |

| t_all | 5-year time periods |

| t_to_i_to_dev(t, i, dev) | Mapping between time region and economic development status |

| t(t_all) | Simulated time periods |

Xiaoxi Wang

09_drivers, 12_interest_rate, 13_tc, 39_landconversion, 41_area_equipped_for_irrigation

Wang, Xiaoxi, Anne Biewald, Jan Philipp Dietrich, Christoph Schmitz, Hermann Lotze-Campen, Florian Humpenöder, Benjamin Leon Bodirsky, and Alexander Popp. 2016. “Taking Account of Governance: Implications for Land-Use Dynamics, Food Prices, and Trade Patterns.” Ecological Economics 122 (February): 12–24. https://doi.org/10.1016/j.ecolecon.2015.11.018.